Google is the internet’s default starting point. Every search, YouTube view, and Maps query is a signal of what billions of people want in the moment. Those signals flow into one of the most powerful attention marketplaces ever built, a system that connects advertisers to intent at an unmatched global scale.

That marketplace brings in hundreds of billions in revenue for Alphabet every year. Search ads remain the foundation, generating around $200 billion, while YouTube, cloud services, and other business lines add billions more. By combining global reach, unmatched data, and AI-driven targeting, Google has built a system that shapes what people see, click, and buy across the modern internet.

In this breakdown, we’ll unpack how that system works, where Google’s money comes from, and the forces that could challenge its dominance.

Table of Contents

How Google works

Google was founded in 1998 by Stanford PhD students Larry Page and Sergey Brin. What began as a university research project quickly evolved into the world’s most powerful search engine. The company’s mission has remained consistent since its early days: "To organize the world’s information and make it universally accessible and useful."

Today, Alphabet operates as a sprawling digital ecosystem worth over $2 trillion. Its products support everything from communication and navigation to productivity, entertainment, and enterprise infrastructure. Google’s services are deeply embedded into the daily lives of billions.

The company’s flagship offerings include Google Search, Chrome, Android, YouTube, Gmail, Google Maps, Google Photos, and Google Workspace.

A portion of Google’s products aimed at wider audiences

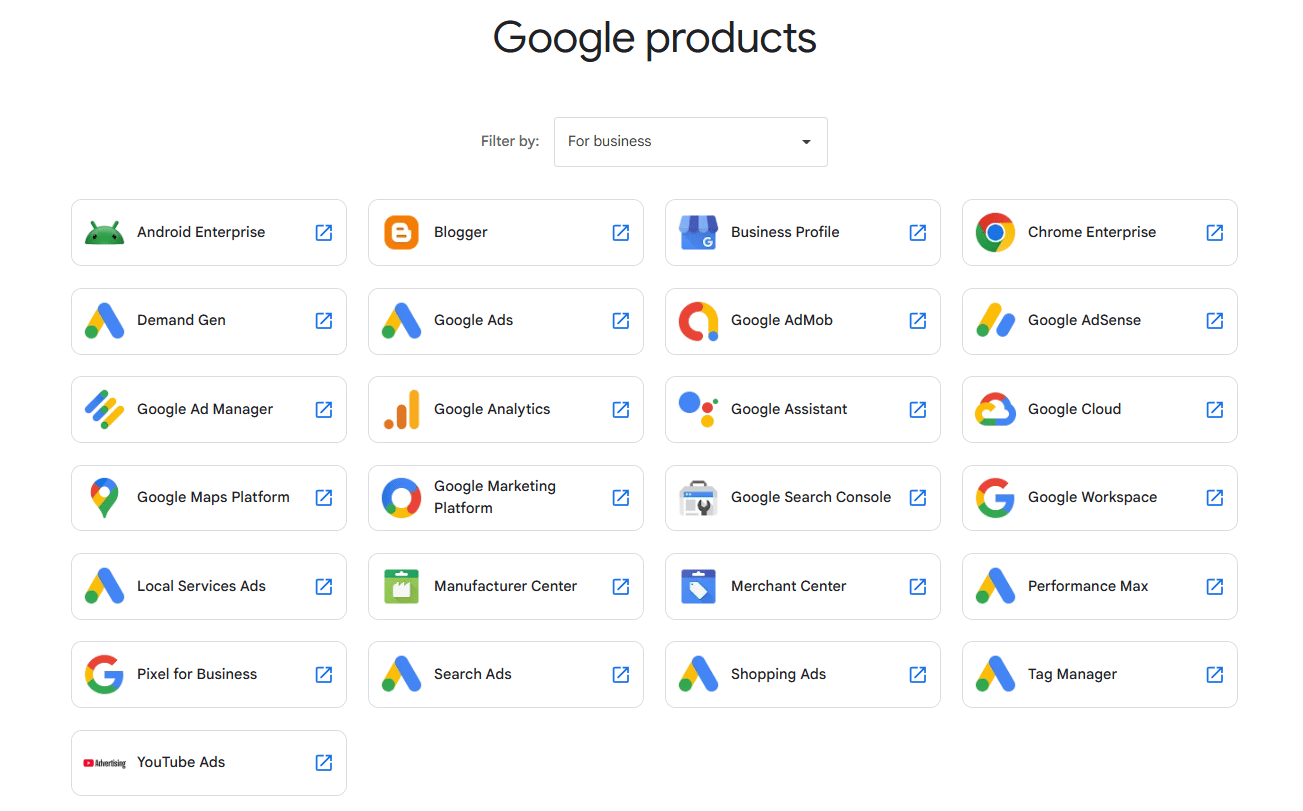

For businesses, Google provides powerful tools through Google Cloud Platform (GCP), Google Ads, and its enterprise edition of Workspace.

Google’s suite of products focused on businesses

On the hardware front, it sells Pixel phones, Nest smart home devices, and Chromecast — more for ecosystem control than direct profit.

Most users interact with Google services dozens of times per day. Behind the scenes, Google Search processes queries through a three-part system:

Crawling the web to discover content

Indexing pages and media

Ranking results based on relevance and hundreds of algorithmic signals

Ads are seamlessly layered into this experience using real-time auctions that respond to user behavior, context, and intent.

Google’s dominance in search — with around 90% global market share — gives it unmatched reach. AI now powers much of the user experience, from Gemini’s integration in Search to predictive features in Gmail. This is amplified by the way Google’s services work together with Gmail, Calendar, Meet, and Drive forming a tightly integrated productivity suite.

At its core, Google operates a marketplace model monetizing attention and intent. It connects advertisers with users through its keyword-based ad auction. Most of its revenue still comes from advertising.

Strategic partnerships further extend Google’s reach. It pays Apple to remain the default search engine in Safari. YouTube shares revenue with creators, ensuring content supply. Together, these integrations and incentives reinforce Google’s dominance across the web.

Google’s revenue streams

Alphabet’s revenue has climbed steadily in recent years from $282 billion in 2022 to $350 billion in 2024. Search ads remain the largest revenue driver, but a range of other revenue streams are also growing in importance.

Google Search

In 2024, Google Search brought in $198.08 billion — around 61.4% of Alphabet’s total revenue. This segment includes revenue from ads served on Search, Maps, Gmail, and other core services. It remains Google’s financial foundation.

The business runs on a pay-per-click (PPC) auction model. Advertisers bid on keywords, and Google ranks ads using a combination of bid price and ad quality — a metric known as Ad Rank. The average cost-per-click in the U.S. is roughly $2.32, though it can rise above $8 in high-value verticals like law and insurance.

AI is amplifying this core engine. Features like AI Overviews and Gemini increase search volume, generate more clickable surfaces, and help Google serve more relevant ads. The result is better matching between user intent and ad inventory, which drives performance for advertisers and revenue for Google.

An example of ads served in AI Overviews

YouTube ads

YouTube generated $36.15 billion in ad revenue in 2024, contributing around 11.2% of Alphabet’s total. The platform monetizes through a mix of skippable and non-skippable video ads, display banners, programmatic inventory, and Shorts Feed placements.

Advertisers pay based on cost-per-view (CPV), typically between $0.01 and $0.03. Monetization triggers once a user watches 30 seconds or interacts with the ad, whichever comes first.

YouTube shares revenue with content creators to maintain supply: 55% of revenue for Watch Page Ads and 45% for Shorts Feed Ads.

YouTube offers creators various ways to monetize, as seen below:

Different ways creators can monetize their YouTube channels

AI plays a key role in boosting engagement. Personalized video recommendations increase time spent on the platform, which expands ad inventory and drives more impressions.

Google Search Network (AdSense, AdMob, Display)

Google Network revenue dropped in 2024, falling to $30.36 billion from over $31 billion the previous year. This segment includes ads shown on third-party websites and mobile apps using AdSense, AdMob, and the Google Display Network.

Google’s network revenue model is based on a revenue-share system. Historically, publishers received 68% of the ad revenue while Google retained 32%. In 2024, the company announced a policy change that increased publisher share to 80% after platform fees. The adjustment did not materially change Google’s take-rate but may have affected how revenue is classified.

Google Cloud

In 2024, Google Cloud generated $43.23 billion, accounting for roughly 13.4% of Alphabet’s total revenue. The segment includes both Google Cloud Platform (GCP) and Google Workspace subscriptions. Its growth has turned it into one of the company’s most important diversification plays beyond advertising.

Revenue is driven by a mix of pricing models:

Pay-as-you-go: for flexible, on-demand usage

Committed-use contracts: offering discounts of up to 57% for 1–3 year terms

Google Cloud achieved profitability in 2023, and its margins have continued to improve as operations scale. Average revenue per user (ARPU) varies depending on service tier and contract structure, but ongoing efficiency gains are driving healthier unit economics.

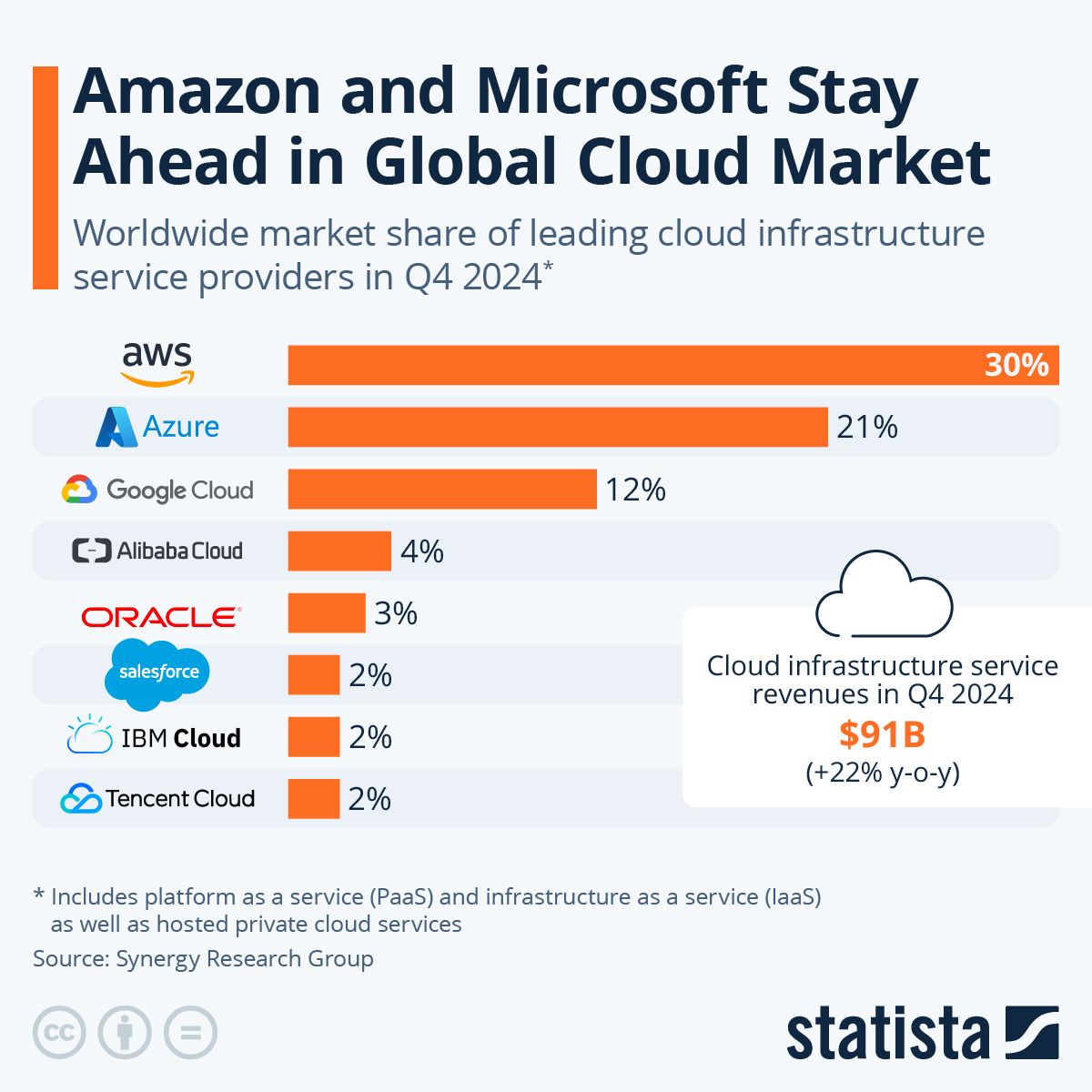

Global cloud market share SOURCE: Statista

Google Subscriptions, Platforms, and Devices

This segment brought in $40.34 billion in 2024, making up approximately 12.5% of Alphabet’s total revenue. It combines three core pillars: app store transactions, premium content subscriptions, and first-party hardware.

The Google Play Store remains a key driver. Google takes a 15% commission on a developer’s first $1 million in annual revenue, then moves to a standard 30% rate. Rates are adjusted depending on the nature of the product — lower for subscriptions, higher for digital goods like in-game purchases.

YouTube Premium and Music subscriptions contribute a growing share, offering users an ad-free experience while diversifying Alphabet’s income beyond ads. Hardware sales, including Pixel phones, Nest smart devices, and Chromecast, round out the segment. These products carry thin margins, but serve as ecosystem anchors that deepen user dependence on Google services.

Google’s cost centers

Google's $350B revenue engine doesn’t run cheap. Powering billions of daily user interactions across search, video, cloud, and mobile requires massive ongoing investment in physical infrastructure and top-tier talent. The company’s biggest expenses fall into five buckets: AI-driven R&D, data center buildouts, traffic acquisition, headcount, and ongoing regulatory overhead.

Research & development (R&D)

In 2024, Google spent $49.3 billion on R&D, roughly 14 to 15% of its total revenue. This cost fuels everything from foundational AI models like Gemini and AlphaEvolve to product-level innovations such as AI Overviews in Search and generative tools in Workspace.

The company’s largest areas of R&D focus include:

AI infrastructure and model development

Search relevance and ranking

Ad system optimization

Enterprise cloud tooling

R&D is a strategic moat. Google’s heavy investment directly supports ad performance, user engagement, and long-term revenue diversification. Innovations born in R&D often become key differentiators in Google’s ecosystem, especially in AI-native enterprise use cases.

Data centers & infrastructure

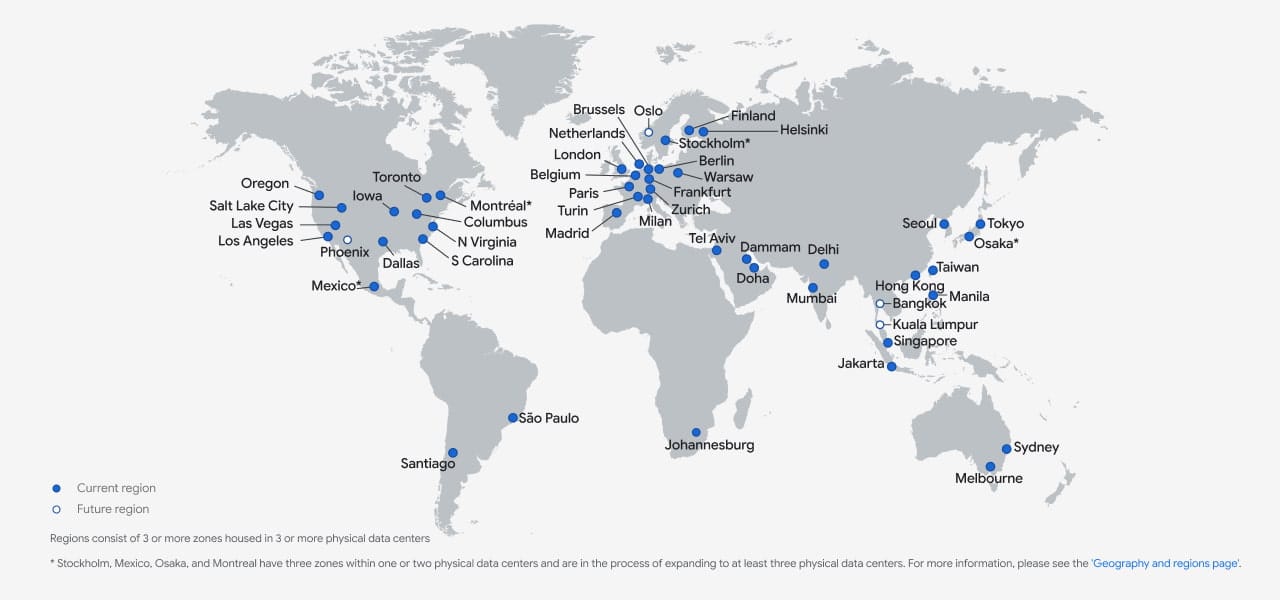

Google’s capital expenditures are projected to reach nearly $85 billion in 2025. This is one of the highest capex levels in the tech industry. These fixed costs support a vast global network of hyperscale data centers, networking equipment, custom chips like Tensor Processing Units (TPUs), and backend systems that power the entire Google ecosystem.

This infrastructure underpins search, YouTube, cloud compute, Gemini, and various other Google products.

Performance, scalability, and latency all depend on these investments. Google operates one of the most advanced infrastructure stacks in the world, a core reason it can maintain high-speed services with near-perfect uptime.

Google’s cloud center locations

Staffing

In 2024, Google reported $22.79 billion in stock-based compensation alone. The company employs more than 150,000 people, with a heavy concentration in engineering, research, and product development roles.

A large portion of Google’s talent is located in high-cost markets like the Bay Area, New York City, and Zurich. This geographic footprint significantly adds to its overhead.

While expensive, Google’s talent strategy is central to maintaining its innovation pipeline. The company’s best-in-class technical teams are directly responsible for developing the infrastructure, models, and products that drive its revenue engine.

Marketing spend

Google’s traffic acquisition costs totaled $13.75 billion in just Q1 2025, putting the company on track for over $55 billion annually. These variable expenses are crucial to maintaining the volume of search queries that power its ad engine.

TAC includes payments to:

Apple, to remain the default search engine on Safari (estimated at $20 billion per year)

Android OEMs like Samsung

AdSense and AdMob publishers as part of Google’s revenue-sharing model

These payments ensure Google retains visibility and traffic across platforms it doesn’t own directly. They are a foundational input to ad revenue because more queries mean more auctions.

Beyond TAC, Google also invests heavily in YouTube Premium and Music subscription promotions, Pixel device marketing campaigns, and enterprise branding for Google Cloud.

One-off or strategic investments

Some of Google’s biggest expenditures are one-time or long-horizon bets. These include infrastructure ramp-ups, acquisitions, restructuring charges, and moonshot R&D.

Examples include:

Custom silicon development for AI workloads, including TPUs

High-profile acquisitions like Fitbit, Mandiant, and DeepMind integration into core teams

Restructuring efforts: $1.8 billion in office lease write-offs in 2023 and over $2 billion in severance packages

Alphabet also deploys capital into speculative, long-term ventures like its fusion energy partnership with Commonwealth Fusion Systems and the continued expansion of Waymo.

Google invested in Commonwealth Fusion Systems’ project

Some of these investments may never pay off, but others — such as DeepMind’s foundational AI research — directly contribute to revenue-generating businesses like Ads and Cloud.

Google’s competitors

Despite its dominance, Google faces intense competition across every one of its core businesses. Its rivals are deep-pocketed, fast-moving, and increasingly focused on AI as the next battleground.

Microsoft (Bing, Azure, Copilot)

Microsoft is Google’s closest rival across multiple fronts: search, cloud, productivity, and AI. Bing challenges Search, Azure competes with Google Cloud, and Copilot is positioned as a direct alternative to Gemini.

Microsoft has strong enterprise ties and a head start in bundling AI into its core products. Its partnership with OpenAI gives it brand power in AI, while Azure continues to outpace Google Cloud in revenue.

But the company trails in consumer engagement. Bing holds just 4% of the global search market versus Google’s 90%, and Microsoft has little traction in mobile.

Recent moves highlight an enterprise-first strategy:

Integrated GPT-powered Copilot into Bing and Edge

Invested heavily in Azure’s AI infrastructure

Bundled Copilot across Microsoft 365

Microsoft may not unseat Google in consumer products, but it poses a growing threat in cloud and workplace software as AI becomes central to both ecosystems.

Amazon (retail search, AWS, advertising)

Amazon competes with Google on cloud infrastructure, product-related search, and digital advertising. AWS is a clear leader in cloud, and Amazon’s retail search now captures a growing share of product-intent queries.

Amazon’s strength lies in commerce. It owns shopper data, dominates product search, and monetizes with a high-margin ad business. AWS controls the largest slice of global cloud spend at around 31%, compared to Google Cloud’s 12%.

Where it falls short is horizontal search and AI branding. Amazon lacks a true Google Search competitor, and its AI platform doesn’t yet carry the visibility of Gemini or Copilot.

Amazon has expanded its ad inventory to platforms like Prime Video and Twitch, invested heavily in AI-driven retail media and targeting capabilities, and gained momentum as advertisers begin shifting budgets away from Google Shopping and toward Amazon’s ecosystem.

Amazon owns a range of companies SOURCE: The Motley Fool

While it doesn’t compete head-on in general-purpose search, Amazon’s grip on retail discovery makes it a direct threat to Google’s ad business as commerce becomes a bigger part of search.

Meta (Facebook, Instagram)

Meta competes with Google for digital ad dollars, especially in mobile and display. Its social platforms, including Facebook and Instagram, command massive daily engagement and offer sophisticated AI-powered targeting tools for advertisers.

Meta’s strength is user attention. Reels monetization has improved, and Meta’s AI models optimize both content discovery and ad performance across its ecosystem. Its weakness, however, is intent. Unlike Google, Meta doesn’t capture high-intent queries. It's also more vulnerable to platform-level shifts, like Apple’s App Tracking Transparency policy.

Meta’s ad business remains formidable. In Q2 2025, it generated roughly $47 billion in ad revenue, compared to Google’s $71 billion. It controls about 25% of the global digital ad market.

Recent developments show Meta leaning further into AI and short-form content. It’s scaling Reels as a core monetization surface, rolling out new AI tools for campaign automation, and using its Llama models to power both consumer-facing assistants and internal optimization systems.

While Meta doesn’t directly compete with Google in search, it does fight for the same advertiser budgets. And as AI makes display and social ads more performance-driven, the overlap will only grow.

TikTok (For You feed, search ads)

TikTok is challenging Google — especially YouTube — for user attention, ad spend, and cultural influence among younger demographics. Its short-form video format, powered by a highly effective AI recommendation engine, has redefined how audiences consume content.

Its biggest strength is engagement. TikTok boasts more than 1 billion monthly users, and its For You feed drives unparalleled time-on-platform. While it lacks a robust search function and under-monetizes compared to YouTube, it’s steadily chipping away at YouTube’s dominance in short-form video and creator attention.

TikTok is now testing search ads and sponsored results, expanding creator tools, and launching new revenue-sharing programs. It’s also building out live-stream commerce and in-app shopping, a move that blends entertainment and retail in ways Google’s platforms don’t yet replicate.

The future of Google

Google is executing a decisive pivot from a search-first to an AI-first company. Gemini, its flagship AI model, is being embedded across the ecosystem: Search, Workspace, YouTube, Android, and Chrome. This shift represents more than a product upgrade.

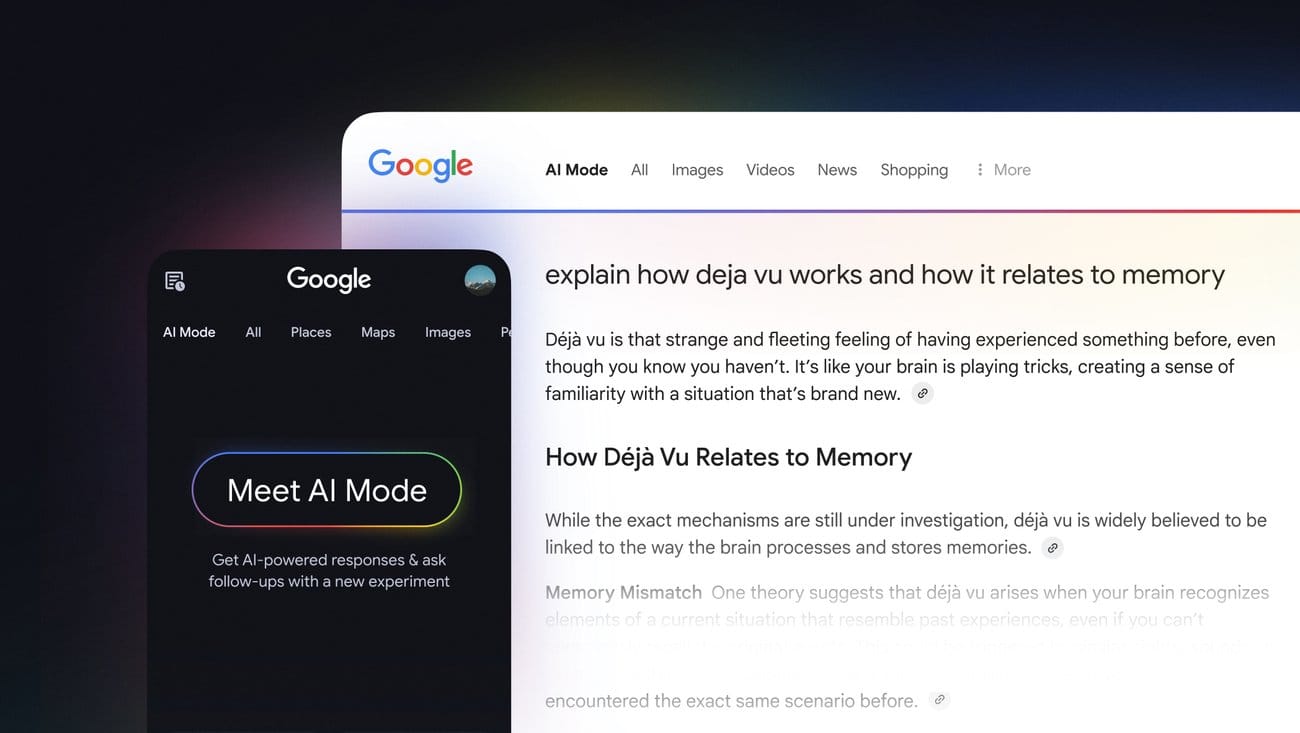

In Search, AI Overviews and the new AI Mode replace the familiar “10 blue links” with direct, synthesized answers. For Google, it’s a generational change in how queries are handled and how ads will be integrated.

Google’s AI Mode is likely the future UI of search

This transformation is backed by unprecedented capital investment. Alphabet expects to spend roughly $85 billion in capex in 2025, primarily to expand AI-ready infrastructure. Much of this will fund TPU-powered data centers designed for generative AI workloads, supporting both consumer products and enterprise clients on Google Cloud. Despite the scale of this outlay, the company remains profitable and has started returning cash to shareholders via a new $0.84 annual dividend, a sign of long-term confidence in its earnings power.

That optimism is tempered by rising regulatory risk. A series of upcoming court rulings may potentially separate Chrome or Android from Google’s core advertising business. In the UK, additional rulings on market dominance in search and mobile platforms are under review. These cases could reshape Google’s distribution advantages, particularly its ability to secure default positions on devices.

Beyond the core business, Google is pursuing several strategic bets:

Fusion energy: A power purchase agreement with Commonwealth Fusion Systems for 200 MW from its first ARC plant, targeted for the early 2030s.

AI-powered scientific discovery: DeepMind’s AlphaEvolve automates high-performance algorithm generation, with applications from chip design to climate modeling.

AI-enabled healthcare and science: Projects applying Gemini and Google Cloud’s AI stack to drug discovery, disease modeling, and sustainability analytics.

If successful, these and other moves will entrench Google as both the market leader in AI-powered consumer and enterprise tools, and as a long-term player in solving complex societal problems. The challenge will be to grow under the weight of regulation while monetizing a fundamentally different search experience.