Netflix built one of the largest media businesses in history by doing what Hollywood said was impossible: charging a monthly fee for unlimited content, with no ads in sight. For over a decade, subscriptions alone funded its rise from a DVD startup into a $40B+ revenue machine with over 300 million paying members worldwide.

That purity is now gone. Growth slowed, competition intensified, and Netflix quietly rewired its business model. Advertising is on and password sharing is no longer tolerated. And for the first time in its history, Netflix is buying scale instead of building it, placing an $82.7 billion bet on Warner Bros. Discovery’s studio and streaming assets.

This breakdown explains how Netflix actually makes money today, how its economics have shifted under pressure, and why the company is transforming from a subscription-first streamer into a vertically integrated entertainment giant built to control global attention.

Table of Contents

How Netflix works

Netflix was founded in 1997 in Scotts Valley, California by Reed Hastings and Marc Randolph. The company started as a DVD-by-mail service designed to challenge Blockbuster's late fees.

Netflix cofounders: Reed Hastings and Marc Randolph

The critical inflection point came in 2007 when Netflix launched instant streaming. At the time, it was positioned as a complementary add-on to physical discs. But leadership recognized that internet bandwidth would eventually render DVDs obsolete. That foresight allowed Netflix to establish an advantage in streaming tech and brand recognition before legacy media companies could respond.

By 2013, Netflix had made another strategic leap: original production. The launch of House of Cards as one of its first major original series transformed the company from a third-party distributor into a vertically integrated producer of premium content. This move insulated Netflix against rising licensing fees from competing studios.

House of Cards was one of Netflix’s first major original series

Today, Netflix operates a global streaming platform available in over 190 countries. The service offers on-demand movies, TV series, documentaries, and mobile games.

The value proposition is straightforward: unlimited viewing anytime, anywhere, without traditional TV schedules or commercials on standard plans. Personalized recommendations powered by sophisticated algorithms keep users engaged. Exclusive Netflix Originals create content that can't be found elsewhere.

Netflix's operational model leverages data in ways traditional studios never could. The company uses viewing patterns and cache data to inform content greenlighting. Unlike Hollywood studios that rely on expensive pilot episodes, Netflix orders full seasons upfront based on algorithmic predictions. This approach allows it to cater to niche interests while identifying global trends, such as the 300% increase in anime viewership over five years.

Squid Game was produced in South Korea but popularized globally by Netflix

Netflix maintains high talent density and compensates employees at the top of their respective markets. This decentralized decision-making environment supports aggressive risk-taking, like investing in high-budget localized content such as Squid Game and Money Heist, which later became global phenomena.

Netflix's revenue streams

Netflix's revenue has climbed steadily in recent years: $33.7 billion in 2023, $39.0 billion in 2024, and a projected $44.8 to $45.2 billion in 2025. That represents year-over-year growth of 15 to 16%, driven by membership expansion and strategic pricing adjustments.

Subscription fees (streaming memberships)

Subscription fees remain the core of Netflix's business. The company offers a three-tiered pricing strategy designed to maximize revenue while remaining accessible to different customer segments.

In the U.S., the Standard with Ads tier costs $7.99 per month, Standard runs $15.49, and Premium is priced at $24.99. Each tier offers different features: Standard with Ads provides 1080p resolution and two concurrent streams, Standard adds ad-free viewing and download capability, and Premium delivers 4K with HDR, spatial audio, and four simultaneous streams.

Regional ARPU varies significantly. In the UCAN region (U.S. and Canada), ARPU reached $17.26 in late 2024. EMEA (Europe, Middle East, Africa) came in at $11.11. LATAM (Latin America) averaged $8.00, while APAC (Asia-Pacific) registered the lowest at $7.34. These differences reflect both purchasing power and competitive dynamics in each market.

Netflix maintains a disciplined pricing approach. The company offers no discounts, annual plans, or student rates. This strategy has allowed consistent ARPU increases in mature markets without training users to expect promotional pricing.

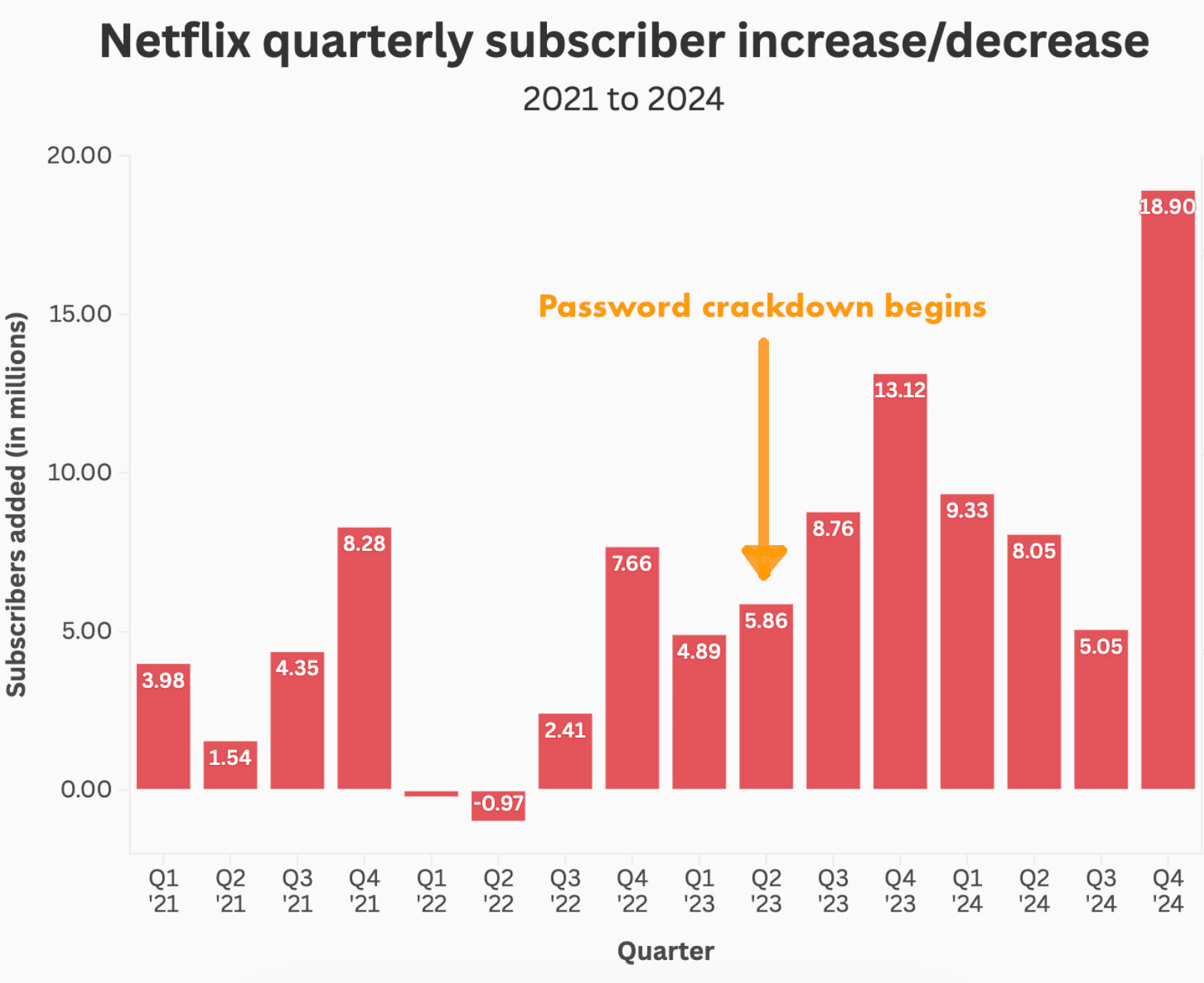

The password-sharing crackdown has been a major driver of subscription growth. When Netflix began prompting members to pay extra for sharing accounts outside one household in 2023, the results were immediate. In the United States alone, daily sign-ups increased by 102% following the announcement. This initiative contributed to a record 19 million net additions in Q4 2024, the largest quarter of growth in the company's history.

Advertising-supported plans

The launch of the ad-supported tier in late 2022 marked a fundamental shift in Netflix's monetization philosophy. For years, the company had insisted on an ad-free experience. That changed when growth slowed and the company needed new revenue levers.

By November 2025, the Standard with Ads tier had reached 190 million monthly active viewers (MAV). This metric accounts for co-viewing patterns, allowing Netflix to monetize the full household reach of its content. The tier now accounts for 40% of new sign-ups in eligible markets, indicating strong demand from price-conscious consumers.

A Booking.com ad on Netflix featuring Idris Elba

The advertising business runs on a hybrid model: users pay a monthly subscription fee while Netflix also earns revenue from ads. The platform serves a mix of skippable and non-skippable 15- and 30-second spots during shows and movies.

Revenue projections show rapid growth. Netflix generated roughly $1.6 billion from ads in 2024 and is expected to double that to over $3 billion in 2025. Executives have stated that advertising could eventually represent at least 10% of total revenue.

Content licensing & other revenue

While Netflix built its empire on exclusive content for its own platform, it does generate some ancillary revenue from content licensing. The company occasionally licenses Netflix Originals to third parties in non-core markets or for specific distribution channels.

These deals are selective and not publicly broken out in detail, but they provide marginal income from content Netflix has already produced. Examples include licensing older seasons of Netflix Original shows to linear TV channels in syndication or to airlines and hotel entertainment systems.

The company has also launched consumer products and experiences to monetize popular intellectual property. This includes selling merchandise for hit shows like Stranger Things and Squid Game through Netflix's online store and retail partners. Netflix is opening "Netflix House" retail locations in 2025 where fans can buy merchandise and dine in show-themed spaces.

Official Stranger Things merch shop by Netflix

Netflix Games offers a catalog of mobile games free to subscribers. The strategy is to boost subscription value and retention rather than generate direct revenue. There are no indications yet of Netflix charging for games or implementing in-game monetization.

These ancillary streams remain minor compared to subscriptions and advertising. Netflix's focus continues to be on monetizing its content and user base within its own platform.

Netflix's cost centers

Running a streaming service at Netflix's scale requires substantial investment. In 2024, the company achieved an operating margin of 27 to 29%. Understanding where Netflix spends money is crucial to understanding how it makes money.

The company's biggest expenses fall into five categories: content production and licensing, technology infrastructure, marketing and customer acquisition, staffing and overhead, and one-off strategic investments.

Content costs (licensing & production)

Content is Netflix's largest expense by far. The company spent approximately $17 billion on content in 2024, with projections of $18 billion for 2025. This massive budget covers producing Netflix Original shows and movies, securing streaming rights for third-party titles, and paying creative talent.

Netflix's content spending is so high because it operates globally and aims to serve diverse tastes. The company invests in marquee English-language productions alongside local-language originals across the world. Korean series like Squid Game, Spanish hits like Money Heist, Indian films, and anime from Japan all require significant investment.

This is largely a fixed-cost business. Netflix must spend upfront to produce or license content, regardless of how many additional viewers that content brings in. Profitability hinges on spreading these huge costs over a growing subscriber base.

Technology & infrastructure

Netflix spends roughly $1 billion annually on its Open Connect content distribution network (CDN) and AWS cloud services. Technology and development expenses totaled nearly $3 billion in 2023, comprising about one-third of operating expenses.

AWS hosts the control plane: user interface, billing, recommendation algorithms, and data analytics. Open Connect handles video delivery through specialized servers placed within ISP networks worldwide. This distributed architecture ensures smooth streaming for 300 million subscribers hitting "Play" simultaneously.

R&D investments support continuous innovation. Netflix's engineering teams develop everything from the apps on various platforms to the recommendation algorithms and compression technology that optimize streaming. Recent investments include downloads, interactive content, UI improvements, and Netflix Games.

As revenue scales up, these tech costs don't rise proportionally, giving Netflix operating leverage. By late 2025, Netflix's gross profit margin reached approximately 48%, a record high indicating better cost efficiency in delivering content.

Marketing & customer acquisition

Sales and marketing expenses totaled $2.92 billion in 2024, up from $2.66 billion in 2023. These costs include traditional advertising, content marketing for originals, brand partnerships, and promotional campaigns.

Netflix forms marketing partnerships with device manufacturers and telecom operators for pre-installation and bundling. When Netflix bundles with a mobile carrier, there's often a revenue share or discounted rate that effectively functions as a marketing cost.

App store commissions for subscriptions purchased through platforms like Apple's App Store represent another expense, though Netflix has tried to circumvent this by directing users to sign up on the web. Payment processing fees for credit cards and other methods scale with subscriber count.

The company also invests heavily in promoting new releases. A show like Stranger Things or Red Notice is accompanied by significant advertising spend to drive viewership and buzz, which in turn drives new sign-ups or retention.

Netflix often uses billboards for promotional purposes

Global campaigns are amortized across Netflix's 190+ country footprint, providing efficiency that smaller competitors can't match.

Staff and overhead

Netflix employs roughly 14,000 full-time employees globally as of 2025. The company is known for its high-performance culture and top-of-market compensation strategy. In 2024, Netflix reported $22.79 billion in stock-based compensation alone.

The workforce includes software engineers, content executives, marketers, customer support, and various specialists in legal, finance, and other functions. A large portion of talent is located in high-cost markets like the Bay Area, New York City, and Zurich, significantly adding to overhead.

General and administrative expenses totaled approximately $1.3 to $1.5 billion in 2024. This covers corporate facilities including the Los Gatos headquarters, Los Angeles production offices, and international offices in London, Mumbai, and elsewhere.

Netflix’s headquarters in Los Gatos, California

Other expenses and one-off costs

Netflix faces various one-time and strategic expenses beyond its core operations. In Q3 2025, the company incurred a $619 million tax liability related to a dispute with Brazilian authorities. This expense reduced the operating margin to 28.2%, below the forecasted 31.5%.

The company carries over $14 billion in debt accumulated during its growth phase. Servicing this debt means paying interest expenses, though Netflix has said it doesn't need to raise new debt and intends to keep leverage moderate.

Netflix has made small acquisitions of game studios and tech companies as it expands into new areas. Integrating these capabilities comes with upfront costs. The company also faces content write-offs when shows are canceled early or licensing deals end abruptly.

Foreign exchange impacts affect reported costs and revenues since Netflix earns in many currencies but reports in USD. European content quota compliance requires funding European productions, which can be seen as a mandated cost of doing business in those markets.

Netflix's competitors

By 2025, the streaming landscape has reached saturation in mature markets, leading to intense competition for viewing minutes. Netflix remains the leader in global streaming time, accounting for 18.3% of all streaming in the U.S. in 2024. But it faces strong regional challenges from well-funded rivals.

Disney+ (and Hulu/ESPN+)

Disney+ is one of Netflix's most formidable competitors, backed by The Walt Disney Company's vast content library and franchises. Launched in late 2019, Disney+ quickly amassed subscribers by offering beloved IP from Disney, Pixar, Marvel, Star Wars, and National Geographic.

As of 2024, Disney+ has around 130 to 150 million subscribers globally, roughly half of Netflix's count. Disney also operates Hulu (focused on general entertainment, mainly U.S.-only with approximately 48 million subscribers) and ESPN+ (sports streaming). Together, Disney's streaming portfolio represents a significant competitive force.

Disney's key strength is its exclusive grip on high-demand family and franchise content. The Mandalorian, Marvel Cinematic Universe shows, and Disney's animated classics drive sign-ups whenever new episodes drop. This iconic content library is a major advantage. Netflix had to build its original content brand from scratch, whereas Disney+ can draw on decades of popular franchises.

Disney+ also skews toward family-friendly content, an area where Disney has an edge due to trust from parents and kids' attachment to Disney characters. The company offers bundles (Disney+ with Hulu and ESPN+) at a discount to increase user stickiness across entertainment and sports.

Disney+ has only rolled out to approximately 100 countries, which is more limited reach than Netflix's 190+ markets. The company initially underpriced its service to grow fast and now faces the task of raising prices without testing consumer loyalty.

Amazon Prime Video

Amazon Prime Video is a top competitor with a fundamentally different business model. Prime Video is part of Amazon's broader Prime membership ecosystem. Amazon has over 200 million Prime members globally who get free shipping and various perks, including access to the Prime Video streaming library.

Amazon's strategy is to enhance the value of Prime membership, thereby encouraging people to shop more on Amazon. As such, Amazon can justify massive spending on video content without needing the streaming service itself to turn a direct profit. It's subsidized by retail revenues.

Prime Video's content includes licensed movies and TV, Amazon Original shows like The Boys and The Marvelous Mrs. Maisel, and premium sports. A big differentiator is live sports: Amazon has acquired rights to NFL Thursday Night Football and Premier League soccer in some regions, making Prime Video a player in sports streaming where Netflix has avoided live sports.

Amazon's greatest strength is its resources and ecosystem. With a market cap in the trillions and a profitable cloud business, Amazon can outspend most rivals. It reportedly paid $250 million just for The Lord of the Rings TV rights and spent over $1 billion producing that single series.

Max (HBO Max / Warner Bros. Discovery)

Max, formerly known as HBO Max, is the streaming service from Warner Bros. Discovery. It launched as HBO Max in 2020, combining HBO's premium series with Warner Bros. content and, after WBD's 2022 merger, Discovery's unscripted and reality content. The service was rebranded as Max in 2023.

Max has approximately 95 to 100 million combined subscribers globally, making it a significant competitor though still smaller than Disney+ and much smaller than Netflix.

Max positions itself as offering both prestige content and broad entertainment. HBO's brand provides marquee quality series like Game of Thrones, Succession, and The Last of Us. Warner Bros. contributes huge film franchises including DC superhero films and the Harry Potter series, plus a deep library of popular sitcoms and dramas.

Max's major strength is the HBO brand and content quality. HBO has a long-standing reputation for top-tier series that draw dedicated audiences. Shows like House of the Dragon become cultural events and can drive subscriber bumps when new seasons release.

Internationally, Max has a more limited footprint than Netflix. Outside the Americas and parts of Europe, HBO had licensed content to local partners, which means Max isn't globally ubiquitous yet. At approximately 100 million users, Max has a smaller subscriber base to amortize content costs compared to Netflix's 300 million.

In December 2025, Netflix announced a definitive agreement to acquire Warner Bros. Discovery's studio and streaming assets for $82.7 billion. This transaction would eliminate a competitor and absorb HBO's content into Netflix. However, Paramount launched a hostile $108.4 billion counter-bid backed by Larry Ellison, creating uncertainty about the deal's outcome.

Paramount+ and Peacock

Paramount+ and Peacock are smaller competitors that operate on similar subscription models. Paramount+ is run by Paramount Global and has around 60 to 80 million subscribers globally. Peacock is from NBCUniversal (Comcast) and has approximately 20 million paid U.S. subscribers.

Paramount+ offers content from the Paramount library, CBS shows and originals like Star Trek: Discovery and 1923 from the Yellowstone franchise, and programming from Nickelodeon, Comedy Central, and other sibling networks. It also streams sports like some NFL games and Champions League soccer.

Peacock offers NBC broadcast shows, Universal films, and original series, along with a robust library of sitcoms. The Office famously moved from Netflix to Peacock. The service streams Premier League soccer, WWE wrestling, and other sports.

Both leverage their parent companies' TV content and cross-platform promotion. They have niche strengths: Paramount+ has Star Trek and children's content from Nickelodeon. Peacock has popular comedies and classic TV. Their inclusion of live sports and news is something Netflix lacks entirely.

Apple TV+

Apple TV+ is Apple's entry in the streaming wars, launched in November 2019. The service focuses entirely on original production. Apple has not disclosed subscriber numbers, but industry estimates put Apple TV+ subscribers in the range of 20 to 40 million paying users.

Apple TV+ costs $9.99 per month, undercutting Netflix's standard plans. The service positions itself as curated, quality-over-quantity. Apple has poured money into high-profile original shows and movies like Ted Lasso, Severance, The Morning Show, and the Oscar-winning film CODA.

Apple's greatest strength is financial muscle and patience. As one of the world's richest companies, Apple can sustain Apple TV+ without immediate profit, treating it as a way to increase user loyalty to Apple devices. Apple became the first streamer to win a Best Picture Oscar with CODA in 2022, a sign of its quality strategy paying off.

But Apple TV+ lacks a back catalog of classic or older content, which is important for user retention. From Netflix's perspective, Apple TV+ is a competitor for users' time but not yet a one-to-one substitute for Netflix's breadth. Many Netflix users likely have Apple TV+ as a second service rather than canceling Netflix for it.

The future of Netflix

Netflix's revenue is projected to reach $44.8 to $45.2 billion in 2025, representing 15 to 16% year-over-year growth. The company expects to generate approximately $8 billion in free cash flow, a sign of its transition from growth-at-any-cost to sustainable profitability.

The Warner Bros. Discovery acquisition, if it closes in 2026, will fundamentally reshape Netflix's business. The deal adds HBO, DC Studios, and the Harry Potter IP to Netflix's arsenal. It faces a 12 to 18 month regulatory review, with potential opposition from the DOJ and European Commission.

The transaction represents a complete reversal of Netflix's historical "builders, not buyers" philosophy. For years, the company insisted on organic growth over large-scale acquisitions. The WBD deal signals that Netflix believes consolidation is necessary to maintain its competitive position in a saturated market.

Gaming is evolving from a retention perk into a meaningful business. Netflix is transitioning to cloud gaming on smart TVs, with exclusive titles like GTA: San Andreas. The company has partnered with major developers and acquired small game studios.

Geographic expansion remains a priority. Netflix is focusing on Asia and Africa, underpenetrated markets where it can grow through localized content and mobile-only plans. The company's ability to produce local-language hits like Squid Game demonstrates the viability of this strategy.

The long-term vision is evolution from streaming service to global entertainment company. Netflix wants to control attention across mediums through a vertically integrated, tech-led ecosystem. Live events like the $5 billion, 10-year WWE deal and NFL Christmas Day games serve as anchors for the advertising business, providing high-volume, simultaneous viewing that brands crave.

If successful, Netflix will entrench itself as both the market leader in streaming and a major player in gaming, live events, and experiential entertainment. The challenge will be executing this expansion while maintaining the content quality and user experience that built the business. The company no longer just makes money by streaming movies. It makes money by controlling the global attention economy through a sophisticated, data-driven entertainment platform.