Palantir is the rare Silicon Valley giant that played the long game. While Amazon and Tesla vaulted past the billion-dollar mark in less than a decade, Palantir spent 22 years in the shadows before crossing that revenue milestone. The result? A company with a $420 billion market cap and a price-to-sales ratio over 140.

Rather than racing for scale, Palantir built its foundation brick by brick, weaving together intelligence, defense, and enterprise AI into something more like a modern nerve center than a typical tech platform. Its business model is both patient and complex, echoing the mystique of its Lord of the Rings namesake and the high-stakes domains it serves.

In this article, we'll cover Palantir's rise and its "land and expand" strategy. The rise of Palantir signals a new era where AI and data analytics shape the architecture of national security and business. Understanding this company is a window into how power, information, and technology will be brokered in the years ahead.

Table of Contents

How Palantir works

Palantir was incorporated in May 2003 by Peter Thiel, Nathan Gettings, Joe Lonsdale, and Stephen Cohen, with Alex Karp joining as CEO in 2004. The company emerged from the so-called “PayPal Mafia.”

Alex Karp, CEO and co-founder of Palantir

Thiel’s experience building PayPal’s fraud detection systems seeded the idea: what if the same approach could be used to help governments fight terrorism, but with civil liberties protected by design? This mission-driven ethos remains central.

Today, Palantir is a global software powerhouse, delivering advanced data integration and analytics platforms to more than 1,560 clients across 50+ countries. It offers three foundational products:

Gotham (for government and defense)

Foundry (for commercial enterprises)

Apollo (for CI/CD infrastructure)

In 2023, Palantir launched its Artificial Intelligence Platform (AIP), a fourth pillar that enables organizations to integrate large language models (LLMs) with proprietary data.

Palantir offers a suite of products

The client list is a who’s who of power: the CIA, NSA, FBI, and Department of Defense on the government side; Morgan Stanley, Merck, Airbus, and Fiat Chrysler among commercial customers. This reach is both broad and deep, with Palantir’s software often embedded at the core of mission-critical operations.

At its heart, Palantir solves one of the hardest problems in modern business and government: integrating and making sense of massive, messy data sets. The company’s platforms act as a “digital detective agency,” helping clients uncover hidden patterns, surface actionable intelligence, and drive real-world outcomes. Security and privacy are foundational, enabling Palantir to serve clients in the most sensitive domains. Crucially, the software is designed to augment, not replace, human analysts.

Several features set Palantir apart from the crowded field of data analytics and AI vendors.

Open, pluggable architecture: Publicly documented APIs ensure clients aren’t locked in and can export data in open, non-proprietary formats.

Ontology-driven design: Especially in AIP, this framework connects large language models (LLMs) to real business outcomes, empowering AI agents to handle complex workflows on their own.

Data sovereignty by default: Palantir doesn’t collect, sell, or mine client data. This is a trust-building edge for organizations managing mission-critical or highly sensitive data.

Palantir’s operational model is as distinctive as its technology. The company engages clients through a three-phase “Acquire, Expand, Scale” process.

In the Acquire phase, Palantir often invests heavily upfront, deploying forward-deployed engineers to work side-by-side with clients and tailor solutions to their needs. This hybrid software/services approach is delivered through both Palantir Cloud (SaaS) and on-premise options, providing flexibility for clients with strict security or regulatory requirements. The result is an “incredibly sticky” relationship: once Palantir’s software is woven into a client’s operations, switching becomes costly and disruptive.

In the Scale phase, contribution margins can reach 55%, reflecting the payoff of this patient, high-touch strategy. Strategic partnerships, such as the alliance with DXC Technology for Fortune 2000 enterprises, further extend Palantir’s reach and reinforce its position as a critical infrastructure provider.

Palantir's revenue streams

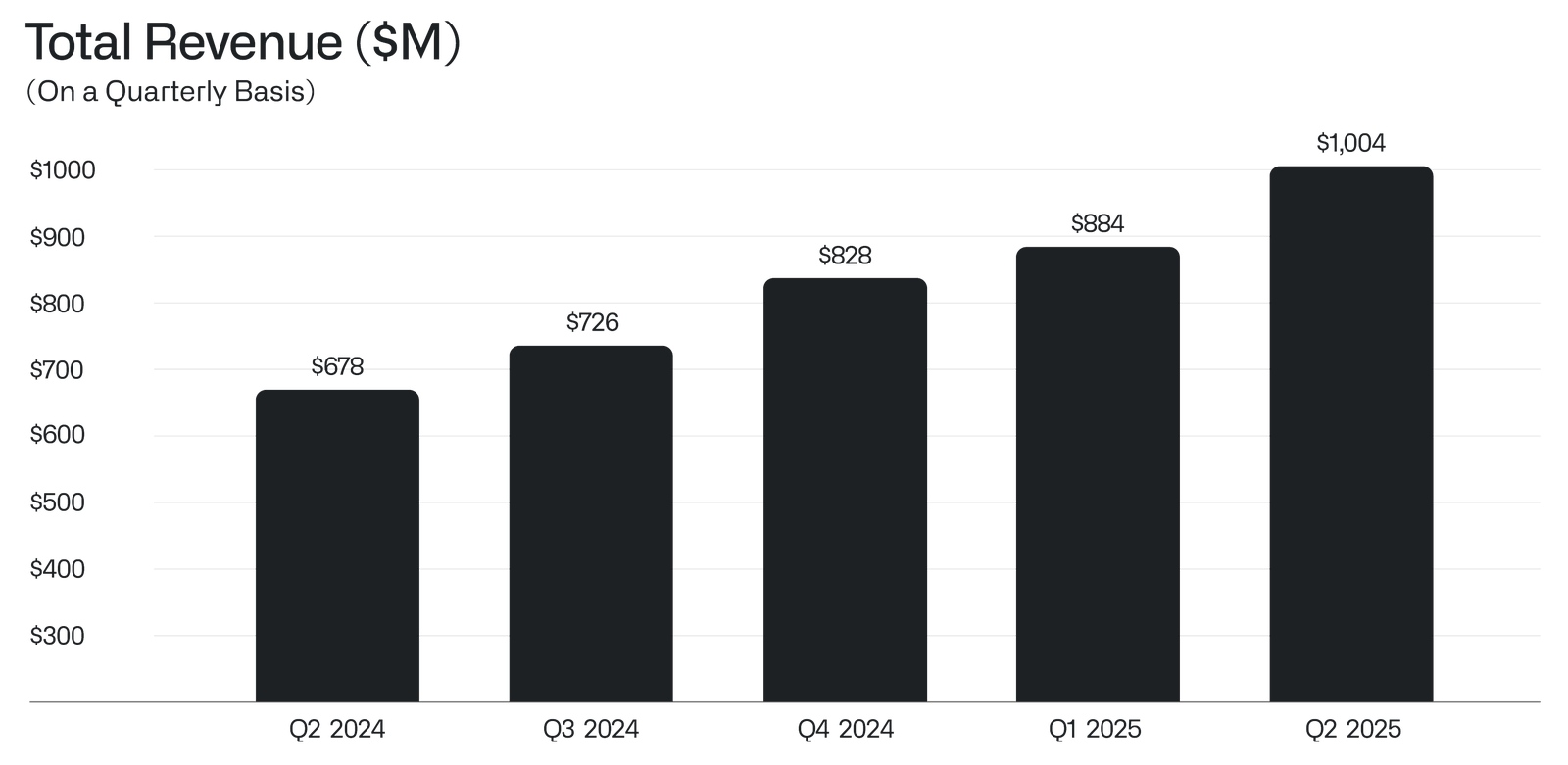

Palantir’s revenue trajectory tells a story of acceleration and inflection. From $1.906 billion in 2022 to $2.866 billion in 2024, the company’s top line has grown at a brisk pace. The real inflection came in Q2 2025, when Palantir posted its first-ever billion-dollar quarter—$1.004 billion, up 48% year-over-year. This surge was driven by the rapid adoption of AIP, especially in the U.S. commercial sector.

Palantir’s quarterly revenue growth Source

Let's go over some of the main streams driving this revenue growth.

Software licensing (subscriptions)

Recurring software licensing is the bedrock of Palantir’s business. Clients license Gotham, Foundry, and increasingly AIP, either through Palantir Cloud (SaaS) or on-premise deployments.

Pricing is typically subscription- or usage-based with tailored contract periods. Multi-year agreements are the norm, reflecting the deep integration required to unlock value. Renewal rates are high, a testament to the platform’s stickiness and the high switching costs once Palantir is embedded.

This recurring revenue scales with the “Acquire, Expand, Scale” model: initial deployments may be small, but as clients expand use cases and data volumes, contract values grow.

Government contracts

Government work remains Palantir’s single largest revenue source, accounting for $1.57 billion (54.8% of total revenue) in 2024, a 28% YoY increase. The client roster reads like a national security briefing: U.S. Army, CIA, FBI, NSA, Department of Homeland Security, CDC, and allied defense ministries.

Contracts are often multi-year and mission-critical. The 10-year U.S. Army deal, worth up to $10 billion and consolidating 75 existing contracts, is a prime example of Palantir’s ability to land and expand within the public sector.

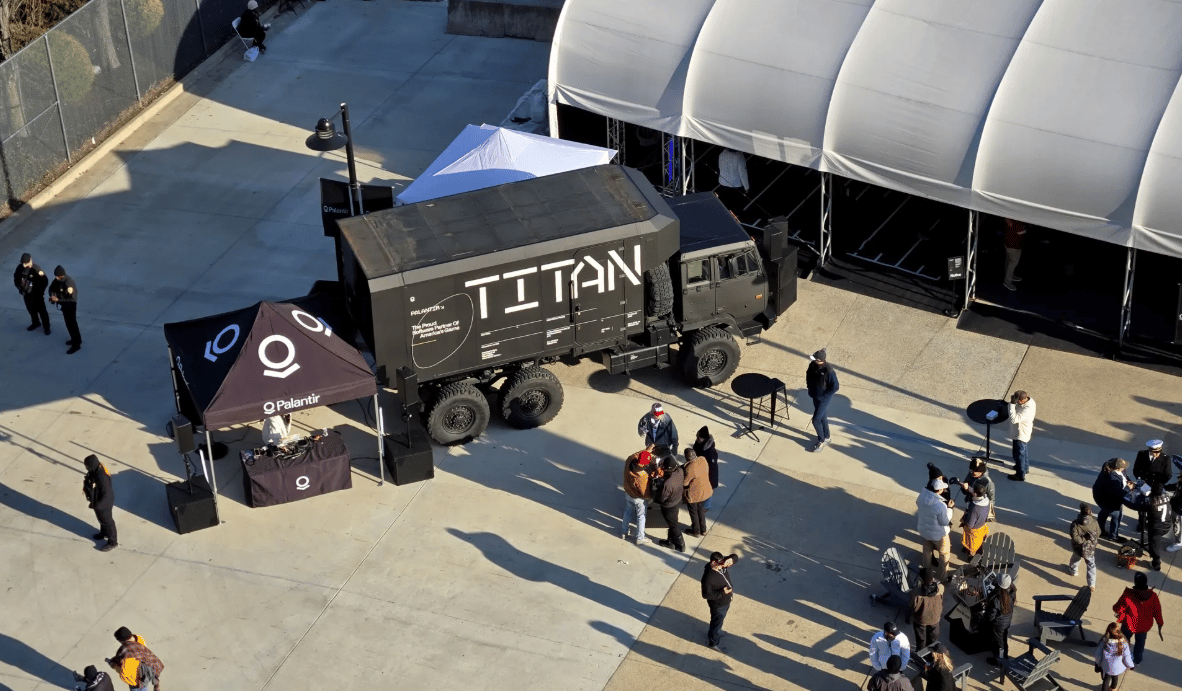

Palantir has built Titan, an AI-focused intelligence gathering vehicle for the US Army

Another notable win: a $100 million Department of Defense contract for AI targeting tools, bundling software access with engineering support. The average deal size is substantial—the top 20 customers average $75 million in trailing 12-month revenue, up 30% annually. Government contracts are stable and prestigious, but also lumpy, with revenue recognition tied to the timing of large awards and public budgeting cycles.

Commercial contracts

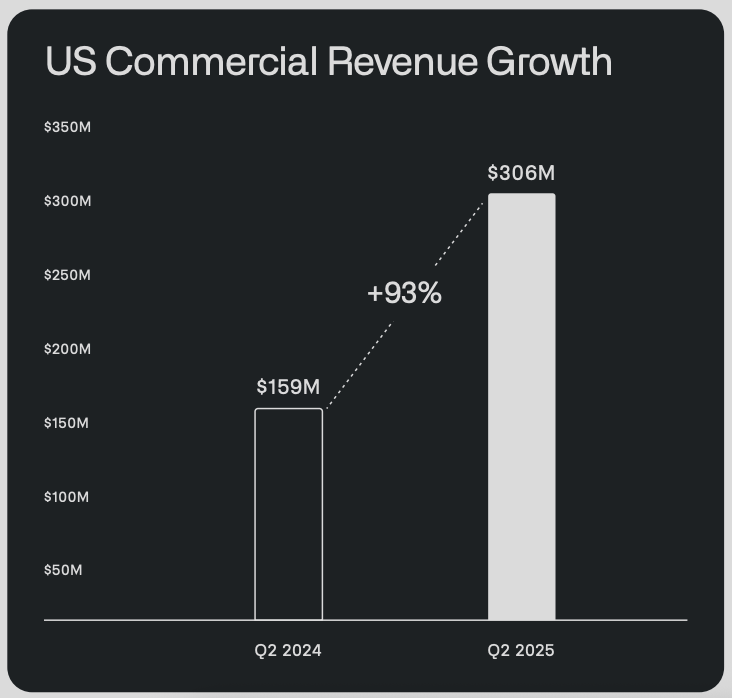

Palantir’s commercial business has shifted from a secondary pillar to a major growth engine. In 2024, commercial revenue reached $1.30 billion (45% of total), growing 29% year-over-year.

The U.S. commercial segment is the standout, surging 68% to $733 million as AIP adoption accelerated. Total contract value (TCV) for U.S. commercial deals exploded 222% to $843 million in Q2 2025, reflecting a strategy that targets “big fish”, large enterprises willing to spend $5–10 million or more annually. Key clients include Morgan Stanley, Merck KGaA, Airbus, PG&E, Fiat Chrysler, and Ferrari.

Palantir made significant progress improving its US commercial revenue stream

The customer base has expanded from roughly 169 commercial clients in 2021 to over 1,500 total customers by 2025, signaling both deepening relationships and a broadening footprint. The revenue model mirrors the government side: annual or multi-year Foundry subscriptions, often bundled with professional services for deployment and customization.

Professional services and customization

While software licensing drives the bulk of revenue, professional services and customization are critical to Palantir’s “land and expand” playbook. These services—consulting, implementation, UI configuration, tailored training, ontology and data modeling—generate revenue, but their primary purpose is to ensure platform adoption and deep integration.

In the Acquire and Expand phases, Palantir often operates at a loss, investing heavily in custom development to adapt its platforms to each client’s unique needs and data ecosystem.

This upfront investment pays off in the Scale phase, where clients become self-sufficient and recurring software revenue dominates.

Palantir's cost centers

Palantir’s cost structure is engineered for long-term advantage. In the next section, we'll break down Palantir’s major cost centers—direct operating expenses, research and development, sales and marketing, and general and administrative costs—to reveal how each supports its distinctive “land and expand” strategy.

Direct operating costs

In Q2 2025, Palantir’s direct operating expenses totaled $193 million, about 19% of quarterly revenue. This bucket covers salaries and stock-based compensation for operations and maintenance teams, third-party cloud hosting bills (primarily AWS), and allocated overhead.

These expenses peak during customer onboarding, when forward-deployed engineers and upfront infrastructure investments are needed to weave Palantir’s platforms into client systems. As integration matures and clients shift into the Scale phase, these outlays drop off, pushing gross margins above 80%.

Palantir’s infrastructure is built for flexibility—operating across multi-cloud, hybrid cloud, and on-premises environments—without the heavy capital drain of owning its own data centers. The result: a spending model that underpins the “land and expand” playbook and fuels strong operating leverage as the company grows.

Research & development

R&D is the lifeblood of Palantir’s competitive moat. In 2024, the company spent $508 million on R&D (17.7% of revenue), up from $405 million in 2023 and $360 million in 2022. Q2 2025 saw $135 million in R&D spend.

Over a third of employees are engineers, many working directly with customers to solve complex challenges. The focus areas are clear: developing AIP, improving core platforms, and advancing automation tools like Apollo.

While R&D spending has increased in absolute terms with the AI push, it has declined as a percentage of revenue, demonstrating operating leverage. Palantir’s “engineering-first” culture ensures that innovation remains a strategic imperative.

Sales & marketing

Palantir’s approach to sales and marketing is unconventional. In 2024, the company spent $888 million (31% of revenue) on sales and marketing, up from $745 million in 2023 and $703 million in 2022. Q2 2025 spend was $244 million.

Rather than mass marketing, Palantir relies on high-touch, relationship-driven business development. The company often bears the upfront costs of pilots during the Acquire phase, creating high barriers for competitors.

Marketing tactics include AI Bootcamps, Demo Days, strategic SPAC investments, and a partnership with IBM for distribution. While customer acquisition costs are high, they are offset by the high lifetime value and expansion revenue from deeply integrated clients.

General & administrative

General and administrative expenses totaled $593 million in 2024, down from $596 million in 2022 and up slightly from $524 million in 2023. Q2 2025 spend was $163 million.

Major components include stock-based compensation, administrative salaries, legal fees, and compliance costs for government contracting. Efficiency gains are evident: Palantir reduced its internal IT staff from 200 to under 80 using AI automation. The 2020 spike to $670 million was driven by direct listing costs and $308.9 million in stock-based compensation. As a percentage of revenue, G&A is trending down, reflecting both scale and disciplined cost management.

Palantir's competitors

Palantir sits at a unique crossroads—government contracting, enterprise software, and AI platforms—facing competition from multiple directions. Its rivals range from technical upstarts to cloud hyperscalers and traditional defense contractors.

Databricks

Databricks is Palantir’s most direct technical competitor in the big-data analytics arena. Databricks stands out for its strengths in data integration, real-time analytics, and scalability.

Palantir, meanwhile, is recognized for its ease of use and robust data governance. Where they truly diverge is in their approach to the market: Databricks favors consumption-based pricing and caters to technical users and data scientists, while Palantir focuses on value-based enterprise agreements aimed at business users and analysts. Their go-to-market strategies are fundamentally different, even as they vie for a share of the same analytics budgets.

Snowflake

Snowflake offers a conventional cloud-based warehousing approach. Palantir’s private operating system model is more specialized, focusing on decision-making frameworks rather than general-purpose data storage.

Palantir can analyze data on Snowflake, but not vice versa—a subtle but important distinction. Snowflake’s gross margins (62–67%) are significantly lower than Palantir’s (80%+), reflecting heavier infrastructure costs.

In practice, many enterprises use both: Snowflake as the data backbone, Palantir for operational analytics and AI. The relationship is both complementary and competitive, with each vying for a larger share of the enterprise data stack.

C3.ai is the closest business model analog, but at a much smaller scale, $390 million in annual revenue versus Palantir’s $2.9 billion, and 200+ customers compared to Palantir’s 1,500+.

C3.ai offers template-based industry solutions, while Palantir delivers custom workflows. C3.ai is considered easier and more cost-effective, but less scalable and secure than Palantir AIP.

The market reflects this difference: C3.ai trades at a significantly lower price-to-sales ratio, suggesting investors see less growth potential. Palantir’s government credibility and scale give it a decisive edge in high-stakes, mission-critical deployments.

Hyperscalers (Microsoft, AWS, Google)

The cloud giants—Microsoft, AWS, and Google—compete with Palantir on cloud services, data integration tools, and AI capabilities. Palantir consistently receives higher reviewer ratings for service/support and ease of integration compared to AWS and Google.

The hyperscalers have immense resources and broader market reach, but Palantir’s specialized solutions and deep domain expertise set it apart. The relationship is complex: Palantir often runs on their infrastructure, making them both competitors and essential partners.

In AI, Microsoft’s Copilot, Google’s Vertex AI, and AWS’s SageMaker are alternatives to AIP, but none offer Palantir’s combination of security, privacy, and operational integration.

The future of Palantir

Palantir’s future vision is as audacious as its history. CEO Alex Karp has set a goal to “10x revenue” while reducing headcount—a “crazy, efficient revolution” that would see Palantir reach $30 billion in annual revenue with fewer than 4,000 employees.

The company has already demonstrated this potential, cutting its internal IT staff from 200 to under 80 through AI automation. The financials support the ambition: FY2025 revenue guidance is $4.142–4.150 billion, with U.S. commercial revenue expected to grow at least 85% to exceed $1.302 billion. Adjusted operating income is projected at $1.912–1.920 billion, with free cash flow of $1.8–2.0 billion.

Strategically, Palantir is positioning itself as the “first software prime” for the Department of Defense and the orchestration engine for enterprise AI. The “America-focused growth strategy” aims to give U.S. corporations and government an “unfair advantage” in a world where AI will divide winners from losers. The rapid adoption of AIP, driving a 134% jump in U.S. commercial contract value, validates Palantir’s pivot toward operational AI.

Key milestones ahead include expanding the commercial business beyond the current 45% revenue share, landing more massive government contracts like the $10 billion Army deal, and penetrating international markets where growth has lagged.

The company’s extreme valuation—P/E ratio of 590, P/S ratio of 145—reflects the market’s confidence in its unique position at the intersection of secure government systems and cutting-edge AI. As Karp puts it, Palantir is “still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades.” For investors and operators alike, the company’s next chapter will be a test of whether patient, mission-driven software can truly reshape the architecture of intelligence, security, and enterprise decision-making on a global scale.