PayPal processes nearly half of all online payments globally, moving $458 billion each quarter across its 438 million accounts. Yet behind those massive flows lies a shrinking margin: the company’s transaction take rate has fallen to just 1.68%. This decline captures the central tension in PayPal’s business: a global leader forced to trade profitability for dominance.

The company that pioneered digital payments in 1998 is now evolving into something far more complex. Its consumer wallet and credit products drive higher-margin growth, while its Braintree unit powers low-margin enterprise processing for companies like Airbnb, Uber, and Shopify. PayPal is deliberately accepting thinner spreads to defend its market share as specialized rivals chip away at its core business.

Understanding how PayPal makes money reveals the balancing act shaping modern fintech. The company sits at the crossroads of e-commerce, banking, and developer infrastructure, competing simultaneously with Stripe’s API-first model, Block’s integrated merchant network, and new AI-driven commerce layers that threaten to reshape the flow of digital transactions.

Table of Contents

How PayPal works

PayPal was founded in 1998 by Max Levchin, Peter Thiel, and Luke Nosek. The revolutionary vision was to create the world's first digital payment platform and make money move faster and easier than before. The platform achieved explosive early growth. It acquired over one million users by 2000, primarily facilitating transactions within nascent e-commerce and auction environments.

PayPal co-founders: Peter Thiel, Luke Nosek, and Max Levchin

Today, PayPal operates as a vast two-sided platform connecting 438 million consumers with millions of businesses across 200+ countries and 25 currencies. The company processed $1.68 trillion in payment volume annually in 2024, establishing itself as the backbone of global digital commerce.

PayPal's core value proposition rests on three pillars that have remained constant since inception:

Trust forms the foundation through comprehensive buyer and seller protection programs, anti-phishing measures, and embedded systems allowing consumers to contest transactions and request refunds.

Global reach extends across more than 200 countries with support for 25 currencies, offering superior international coverage compared to regional competitors.

Flexibility enables multiple payment methods, from PayPal balances and bank transfers to credit card processing and emerging cryptocurrency options.

The company's operational model uses a sophisticated hybrid structure targeting distinct customer segments.

The Branded Platform handles high-margin consumer and small-to-medium business e-commerce checkout. It uses PayPal's recognizable brand to reduce cart abandonment rates.

The Payment Service Provider (PSP) segment, primarily powered by Braintree, focuses on low-margin, high-volume gateway services for large enterprise clients using transparent Interchange Plus Plus (IC++) pricing models.

The P2P Network, anchored by Venmo, facilitates instant money transfers while building engagement among younger demographics.

PayPal's tech infrastructure employs sophisticated funding mix optimization that routes transactions through the lowest-cost channels available. When users fund payments through bank accounts or PayPal balances, costs remain minimal.

Credit card-funded transactions incur higher interchange fees, but PayPal's scale enables volume-based discounts from card networks. The IC++ pricing model for enterprise clients passes interchange fees and scheme fees directly to merchants while adding a transparent, fixed margin on top.

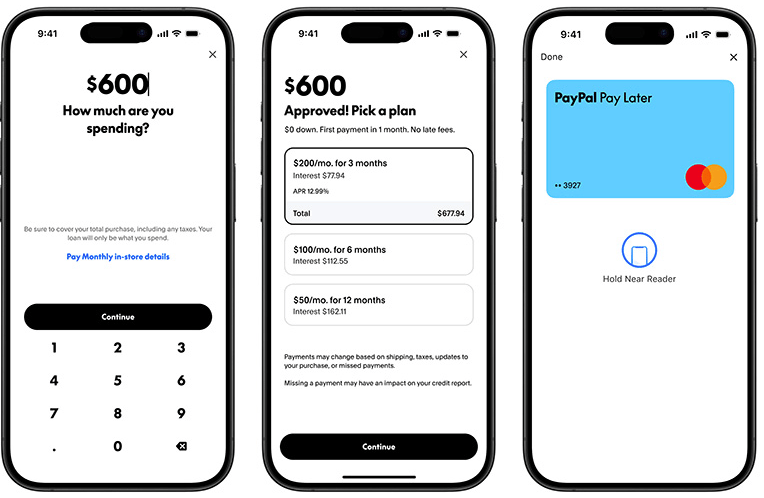

The company’s emerging Buy Now, PayLater (BNPL) service operates without tying up a lot of PayPal’s money. This is achieved via partnerships with financial firms like Blue Owl, which bought $7 billion worth of the outstanding BNPL loans (receivables) from PayPal. This deal moves the loans off PayPal's books while PayPal still manages the service for customers.

PayPal’s revenue streams

PayPal generated $31.80 billion in revenue in 2024, with a fundamental division between Transaction Revenues and Other Value Added Services (OVAS). This 90/10 split reveals the strategic importance of diversifying beyond core payment processing as competitive pressure intensifies.

Revenue category | Contribution | Growth rate | Key metrics |

Transaction revenue | ~90% | 6% Y/Y | 1.68% take rate |

Other value-added services | ~10% | 15% Y/Y | Credit, interest, BNPL |

The faster growth of OVAS compared to transaction revenue signals PayPal's strategic evolution toward higher-margin financial services that can offset the decline in core processing margins.

Transaction revenue: branded checkout

The highest-margin legacy revenue stream is PayPal's branded checkout experience. It’s where consumers complete e-commerce purchases using their PayPal accounts. Merchants typically pay 3.49% plus a fixed fee for domestic transactions, a rate structure that incorporates all processing costs while retaining margins for PayPal.

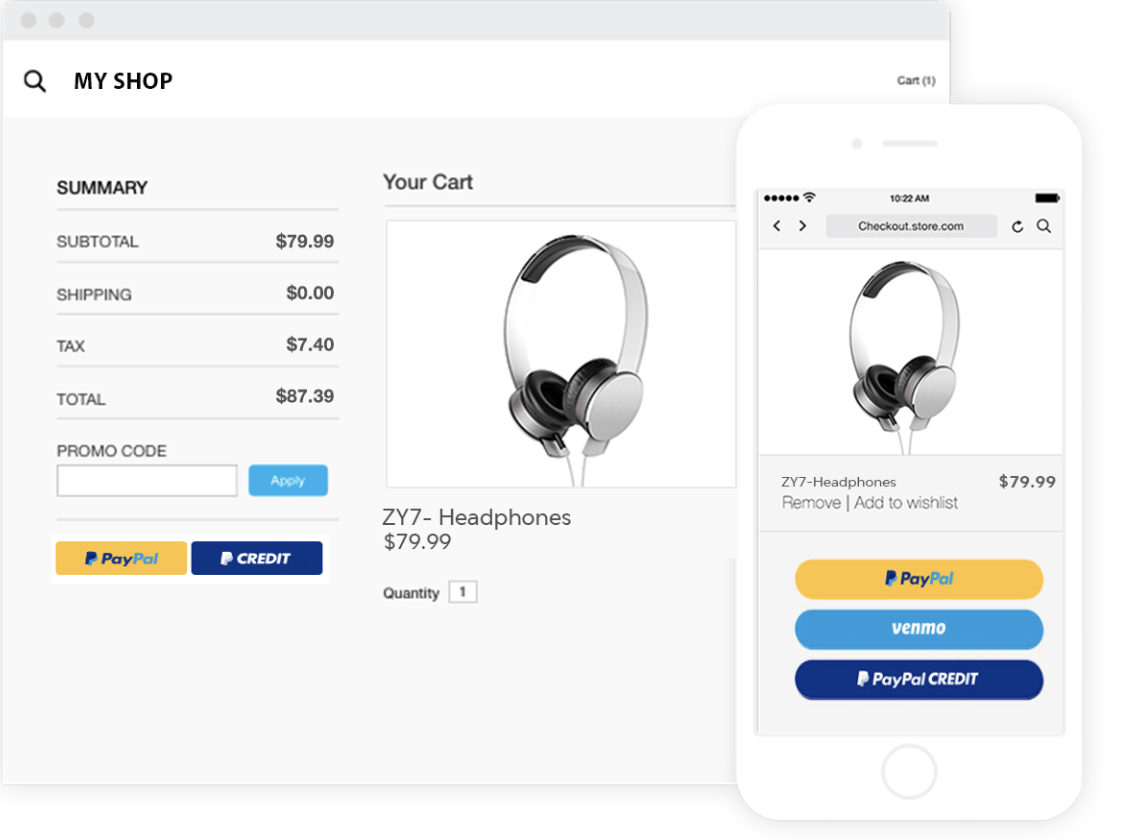

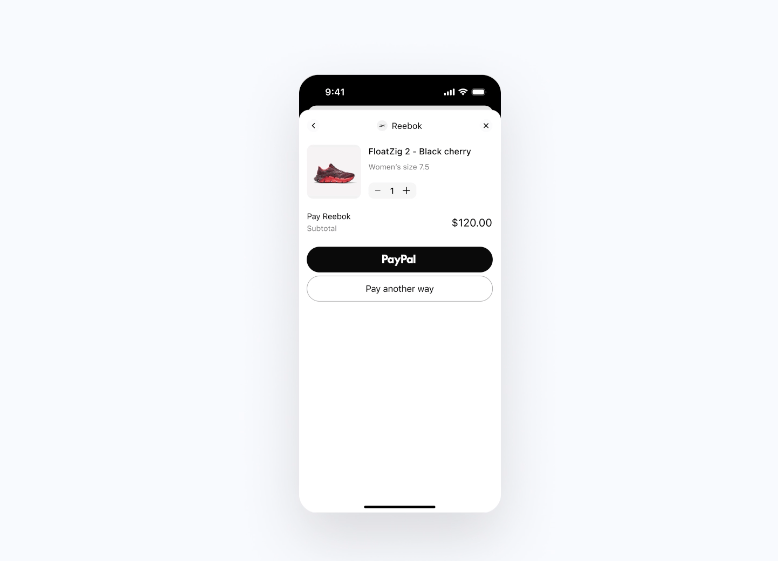

PayPal offers a branded checkout experience for online stores

Despite these high nominal merchant fees, the overall transaction take rate (the percentage of money that PayPal keeps) stands at only 1.68% for Q1 2025. This gap shows how PayPal’s profits per transaction have thinned out as it processes more low-margin payments through Braintree, peer-to-peer transfers, and discounted rates for big merchants.

The branded checkout remains PayPal's profit engine, using consumer trust and brand recognition to command premium pricing. However, volume pressure from competitors and the strategic necessity of defending market share through lower-margin services continue to erode this segment's contribution to overall profitability.

Transaction revenue: PSP/Braintree

Braintree serves as PayPal's payment service provider (PSP) weapon in the battle for enterprise clients against Stripe. While standard Braintree rates reach 2.89% plus $0.29, most large clients receive customized IC++ pricing that provides complete transparency into interchange fees and scheme fees.

PayPal is in the process of rebranding of Braintree

Under the IC++ model, PayPal passes variable costs directly to merchants while adding a defined percentage and fixed fee margin. This transparent pricing structure attracts sophisticated tech companies that demand granular control over payment processing economics. But this model operates at significantly thinner margins for PayPal than branded checkout.

The PSP segment drove 6% year-over-year growth in transaction revenue in Q3 2025. It helps PayPal stay dominant in payment volume even as it pulls down the company’s overall take rate.

Transaction revenue: P2P monetization (Venmo)

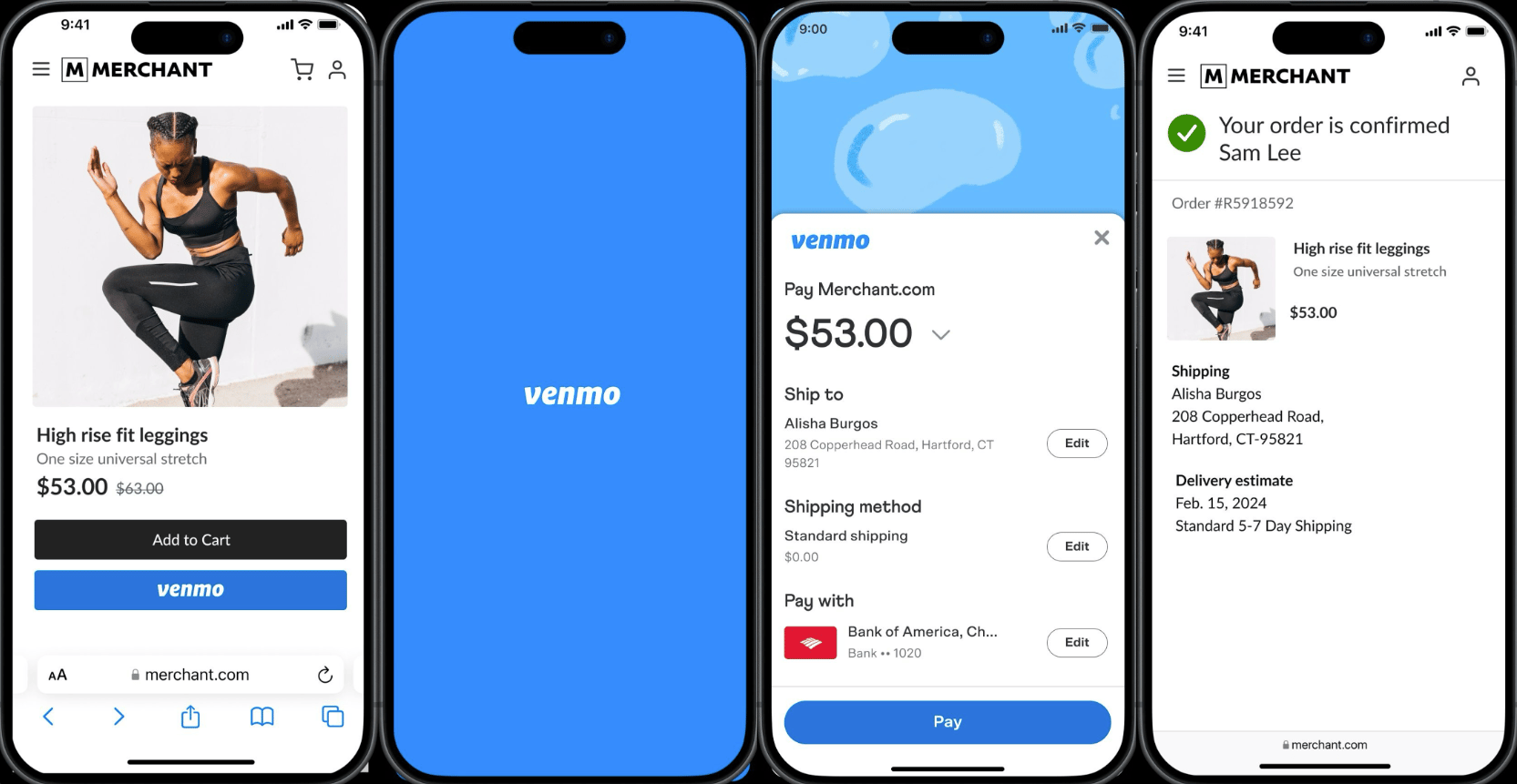

Venmo monetizes its social payment platform through multiple mechanisms while maintaining free basic transfers.

Instant transfer fees of 1.75% (minimum $0.25, maximum $25) generate revenue when users opt for immediate liquidity instead of standard 3-4 day transfers. Credit card funding fees of 3% apply when users fund P2P transfers using linked credit cards rather than bank accounts or debit cards.

The "Pay with Venmo" feature enables commercial transactions at standard merchant rates of 3.49% plus fixed fees. However, Venmo's contribution stands at only 18% of PayPal's Total Payment Volume, significantly lower than competing Cash App's 60% gross profit contribution to Block's overall business.

Venmo can facilitate commercial transactions

This disparity reveals monetization opportunity within PayPal's P2P vertical. Converting more peer-to-peer usage into higher-margin commercial transactions can improve profit and reduce dependence on traditional payment processing margins.

Other value-added services (OVAS)

OVAS is PayPal’s main lever for margin expansion. The segment grew 15% year-over-year in Q3 2025, outpacing 6% growth in transaction revenue. It combines several high-margin income streams that diversify PayPal’s model beyond basic payment processing.

Interest on customer balances: Generates float income from idle funds held across 438 million accounts. Rising interest rates have turned this into a significant profit driver within OVAS.

Consumer credit products: Includes PayPal Credit interest and fees, plus merchant charges for Buy Now, Pay Later (BNPL) transactions, which can reach up to 4.99% plus fixed fees. BNPL lifts merchant average order values by more than 80%, supporting far higher pricing than standard transaction fees.

Balance-sheet-light partnerships: The Blue Owl partnership illustrates PayPal’s strategy of offloading credit exposure while preserving high-margin revenue. Over $7 billion in BNPL receivables were externalized in two years, reducing risk and capital needs while retaining origination and servicing fees.

This mix gives PayPal a scalable, high-margin layer that offsets declining take rates in core payment processing.

PayPal’s cost centers

PayPal recorded $26.47 billion in operating expenses in 2024, resulting in a 40.5% gross margin. In other words, about 60% of its revenue is consumed by transaction costs and operating expenses. The company’s cost structure blends variable costs that rise with payment volume and fixed expenses tied to running its global payments network.

Transaction processing costs

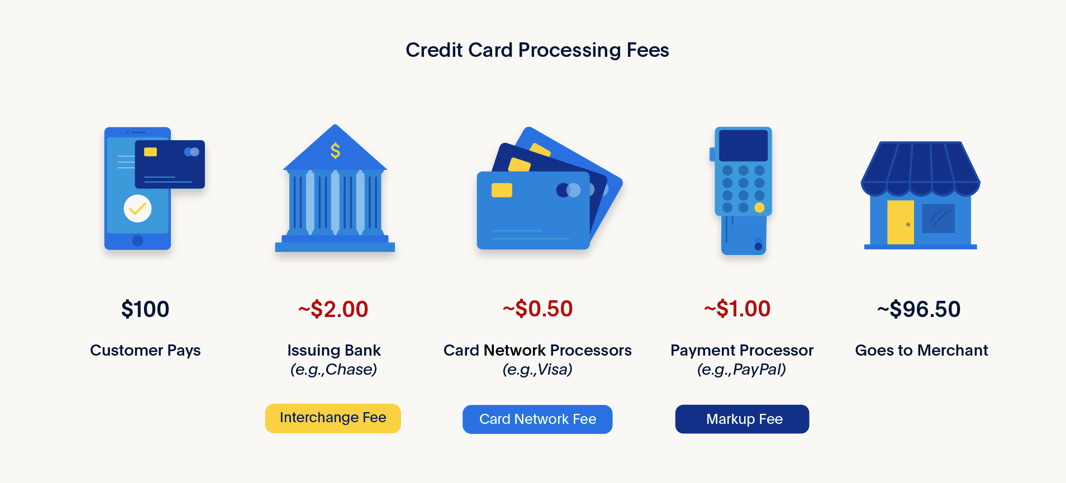

The largest variable expense consists of fees paid to execute card-based transactions, primarily interchange fees to card-issuing banks and scheme fees to networks like Visa and Mastercard. These costs scale directly with Total Payment Volume.

Under the IC++ pricing model, PayPal passes most network and interchange fees directly to merchants while keeping a small margin. The mix of payment methods heavily influences these costs—card payments are far more expensive than those funded by bank accounts or PayPal balances, making it important to steer users toward later cheaper options.

To manage this, PayPal designs its checkout flow and promotions to encourage lower-cost funding sources. However, if users increasingly choose cards over bank or balance payments, the company’s processing costs can rise quickly and squeeze margins.

Transaction and credit loss provisions

Transaction and credit losses reached $483 million in Q3 2025, marking a sharp 37% increase year-over-year. This surge involves fraudulent transaction losses, chargebacks, defaults on credit products including BNPL, and payouts under buyer and seller protection programs.

Shoppers can opt for the PayPal Pay Later option

Rising credit risk costs help explain PayPal’s decision to offload BNPL loans through its Blue Owl partnership. By transferring $7 billion in “Pay in 4” receivables to third-party funds, PayPal avoids higher credit losses that would pressure margins while still earning high merchant fees from BNPL’s 21% annual growth in total payment volume.

PayPal's historical investment in anti-phishing and anti-hacking systems dating to its founding continues through ongoing fraud management costs. This includes operational expenses for proprietary monitoring systems and specialized protection services.

Non-transaction operating expenses

Non-transaction operating expenses totaled $2.303 billion in Q3 2025, growing 6% year-over-year. This category encompasses general and administrative costs, research and development, and marketing spend.

Non-transaction operating expenses rose 6% in Q3 2025—the same rate as Transaction Margin Dollars—showing that PayPal must operate more efficiently if it is to expand operating margin. Major fixed costs contributing to expenses include engineering teams focused on platform security, global data center operations, and regulatory compliance across more than 200 markets.

PayPal’s new CEO, Alex Chriss, reduced the workforce 9% in 2024

Recent workforce cuts, 7% in early 2023 and another 9% under the new CEO in 2024, aim to streamline operations without weakening the innovation capacity.

Technology and development

PayPal invests approximately 11.8% of revenue (~$3.25 billion) in R&D and platform development. Focus areas include AI-driven risk management systems, mobile and point-of-sale technology integration, and development of new advertising platform capabilities.

Key initiatives include:

Tap to Pay integration with Apple devices

AI commerce features embedded across the platform

Infrastructure supporting emerging payment methods like crypto

The relatively high R&D spend reflects PayPal's positioning as a tech company competing on innovation rather than purely on payment processing commoditization.

PayPal’s competitors

PayPal operates across three distinct payment battlegrounds: enterprise payment service processing, branded consumer checkout, and mobile peer-to-peer transfers. The company's 43.4% global market share leadership position faces increasing pressure from specialized competitors excelling in specific segments.

Stripe

Stripe represents PayPal's primary rival in global online payment processing, holding an estimated 20.8-29% market share. The competitive dynamics reveal distinct strategic approaches: Stripe dominates developers and SaaS companies with 78% penetration among subscription businesses, while PayPal leads in consumer trust and SMB adoption.

Stripe's strength lies in sophisticated APIs and rapid innovation cycles that appeal to high-growth tech companies. The platform powers approximately 62% of Fortune 500 companies in some capacity, demonstrating enterprise traction that challenges PayPal's Braintree division directly.

PayPal's response centers on Braintree's IC++ pricing model, which provides the cost transparency and customization that enterprise clients demand. However, this competitive necessity operates at significantly lower margins than PayPal's branded checkout, forcing the trade-off between market share defense and profitability.

Block (Square and Cash App)

Block presents dual-front competition through Square's merchant processing platform and Cash App's consumer P2P service. The competitive positioning reveals different monetization philosophies: Square excels in integrated commerce solutions for physical retail, while Cash App achieves superior P2P unit economics.

Cash App's 55 million monthly active users generate 60% of Block's gross profit. This demonstrates monetization efficiency that significantly exceeds Venmo's 18% contribution to PayPal's Total Payment Volume. Cash App's integrated financial services including stock trading and Bitcoin purchasing create a versatile ecosystem that drives higher gross profit per user.

Square's strength in point-of-sale systems and vertical-specific tools challenges PayPal's Zettle platform in physical retail environments. However, PayPal's global e-commerce dominance and international payment capabilities provide competitive advantages that Square has yet to replicate at scale.

This competitive dynamic forces PayPal to develop super-app capabilities while defending its core payment processing business.

Zelle and traditional networks

Founded in 2017 by Early Warning Services, a consortium owned by major U.S. banks including JPMorgan Chase, Bank of America, and Wells Fargo, Zelle introduced a structural challenge to PayPal’s peer-to-peer model. The platform enables free, instant bank-to-bank transfers directly within banking apps. It bypasses the 1.75% instant transfer fee that Venmo depends on for monetization. This dynamic puts pricing pressure on PayPal’s liquidity services.

Zelle’s main limitation is its narrow U.S. footprint and lack of merchant payment features, areas where PayPal and Venmo maintain an advantage. Still, its zero-fee, instant model highlights consumers’ preference for fast, low-cost payments integrated with their existing bank accounts.

Meanwhile, Big Tech competitors are reshaping digital payments through ecosystem partnerships: Apple Pay’s deep iOS integration reduces checkout friction, Amazon now accepts Venmo for transactions, and Google Pay continues to expand across Android. These moves both validate PayPal’s network position and introduce new payment channels that could weaken dependence on PayPal’s branded checkout.

The future of PayPal

PayPal’s long-term strategy focuses on integrating AI into commerce, strengthening its balance sheet, and expanding into a broader range of financial services.

AI commerce integration is launched through an OpenAI partnership that embeds PayPal directly into ChatGPT. This move anticipates "agentic AI" commerce where digital assistants execute transactions autonomously. PayPal positions against being sidelined in post-browser shopping environments.

PayPal will power payments in ChatGPT

Balance sheet optimization through the Blue Owl partnership illustrates PayPal’s shift toward a “balance sheet-light” approach to consumer credit. By selling $7 billion in BNPL receivables, PayPal frees up capital for tech investment while continuing to earn high-margin merchant fees.

PayPal’s next phase of growth depends on turning its 438 million users into full-service financial customers. The company is evolving from a payment processor into a commerce-focused financial ecosystem to stay competitive against Stripe’s developer-led model, Cash App’s stronger peer-to-peer monetization, and new AI-driven payment platforms. Its ability to execute this shift while preserving market leadership will determine whether PayPal remains the dominant force in digital payments or loses ground to more specialized rivals.