Polymarket has facilitated $23.5 billion in trading volume over three years while reporting exactly $0.00 in protocol revenue. Yet in 2025, this prediction market secured a valuation of up to $15 billion, backed by investors including the NYSE's parent company Intercontinental Exchange (ICE). The platform charges no fees, pays users 4% annual rewards to hold positions, and has spent $112 million to re-enter the U.S. market.

This counterintuitive business model reveals something fundamental about how modern platforms capture value. Polymarket isn't optimizing for today's revenue. It's building toward a token-based monetization system that will transform $23.5 billion in volume into measurable profit. Understanding how the world's largest prediction market operates at a loss while commanding a multi-billion-dollar valuation shows where information markets are headed.

In this breakdown, we'll unpack how Polymarket captures value through hidden revenue mechanisms, why it paid $112 million just for regulatory clearance, and how the upcoming POLY token will turn a zero-fee model into a profitable enterprise.

Table of Contents

How Polymarket works

Polymarket was founded in 2020 by Shayne Coplan under the name Union. The platform emerged at a moment when early blockchain prediction markets like Augur had failed to gain traction, hampered by high Ethereum gas fees and poor user experience. Polymarket's mission was straightforward: democratize access to information markets and provide superior forecasting through crowd wisdom.

Shayne Coplan, the founder of Polymarket

The platform operates as a decentralized exchange for event-based trading. It doesn’t work with fiat currencies, like USD or EUR. Instead, users deposit USDC stablecoin on the Polygon blockchain and trade binary outcome shares priced between $0 and $1 on real-world events. If you buy a "Yes" share at $0.70 and the event happens, you collect $1. If it doesn't, the share becomes worthless. The price at any moment reflects the market's collective probability.

Behind the scenes, Polymarket uses Automated Market Makers (AMMs) for liquidity and UMA's Optimistic Oracle for outcome resolution.

What sets Polymarket apart is its zero trading fees. While competitors like Kalshi charge 1.2%, Polymarket takes nothing. This aggressive pricing strategy, combined with global accessibility via crypto rails, has driven explosive growth. The platform processed $3.3 billion on the 2024 U.S. election alone, with viral Twitter embeds of live odds amplifying its reach.

Polymarket predicted Donald Trump would win the elections in 2024

That growth came with regulatory consequences. In 2022, the CFTC fined Polymarket $1.4 million for operating as an unregistered derivatives exchange and forced it to block U.S. users. The company spent the next three years building toward re-entry. In July 2025, it acquired QCX, a CFTC-registered exchange, for $112 million. The move gave Polymarket the regulatory clearance it needed to serve American customers again.

Polymarket’s revenue streams

Polymarket reports $0.00 in official protocol revenue despite $23.5 billion in trading volume. The platform operates on what amounts to a negative take rate, paying users 4% holding rewards while charging no fees. It's entirely funded by venture capital and burns cash to build liquidity and market share before activating its monetization engine.

This paradox is deliberate. Polymarket isn't capturing value through traditional means. The real revenue model kicks in later, once the POLY token launches and the U.S. platform scales.

Implicit revenue: AMM spread and liquidity capture

Polymarket doesn’t charge trading fees, but its system still generates revenue under the hood. The engine behind this is its Automated Market Maker (AMM)—a pricing model that uses math, not human market makers, to quote prices and guarantee liquidity.

Here’s the key idea: every AMM trade creates a tiny bit of value for the pool. Because prices adjust along a curve, traders always pay slightly more to buy than they would receive if they sold at that exact moment. That built‑in gap—think of it as the AMM’s version of a bid‑ask spread—accumulates over time.

A simple example: If someone buys a YES share at $0.52, the curve might adjust so that the next seller only receives $0.51. That one‑cent difference stays in the pool. On its own, it’s tiny. But across millions of dollars of volume, it becomes meaningful.

Those accumulated spread gains don’t go to external liquidity providers. They flow into Polymarket’s Treasury, which supplies and manages the liquidity. In effect, the platform captures the value that traditional market makers would normally earn.

This stands in sharp contrast to an order‑book exchange. There, human market makers post bids and asks—say, $10.00 to buy and $10.05 to sell. If one trader hits their ask and another hits their bid, the market maker earns the $0.05 spread for providing liquidity. With an AMM, the pool earns the spread instead—and because Polymarket controls the pool, it captures that value directly.

Today, this implicit revenue appears to be Polymarket’s primary source of operational funding. It isn’t reported as income because it’s typically recycled straight back into liquidity incentives or retained in the Treasury. But it’s real, it’s measurable, and without it, zero‑fee trading simply wouldn’t be sustainable.

Treasury yield management

Polymarket manages a substantial pool of deposited USDC collateral, known as Total Value Locked (TVL). This capital sits on the platform as users hold positions in active markets. Rather than letting it sit idle, Polymarket deploys it into yield-generating strategies.

The platform pays out 4% annual holding rewards to users from Treasury funds. To sustain this subsidy without depleting investor capital, the Treasury must earn more than 4% on deployed collateral. The difference between gross yield and the 4% paid to users is net interest margin—a critical but undisclosed revenue source.

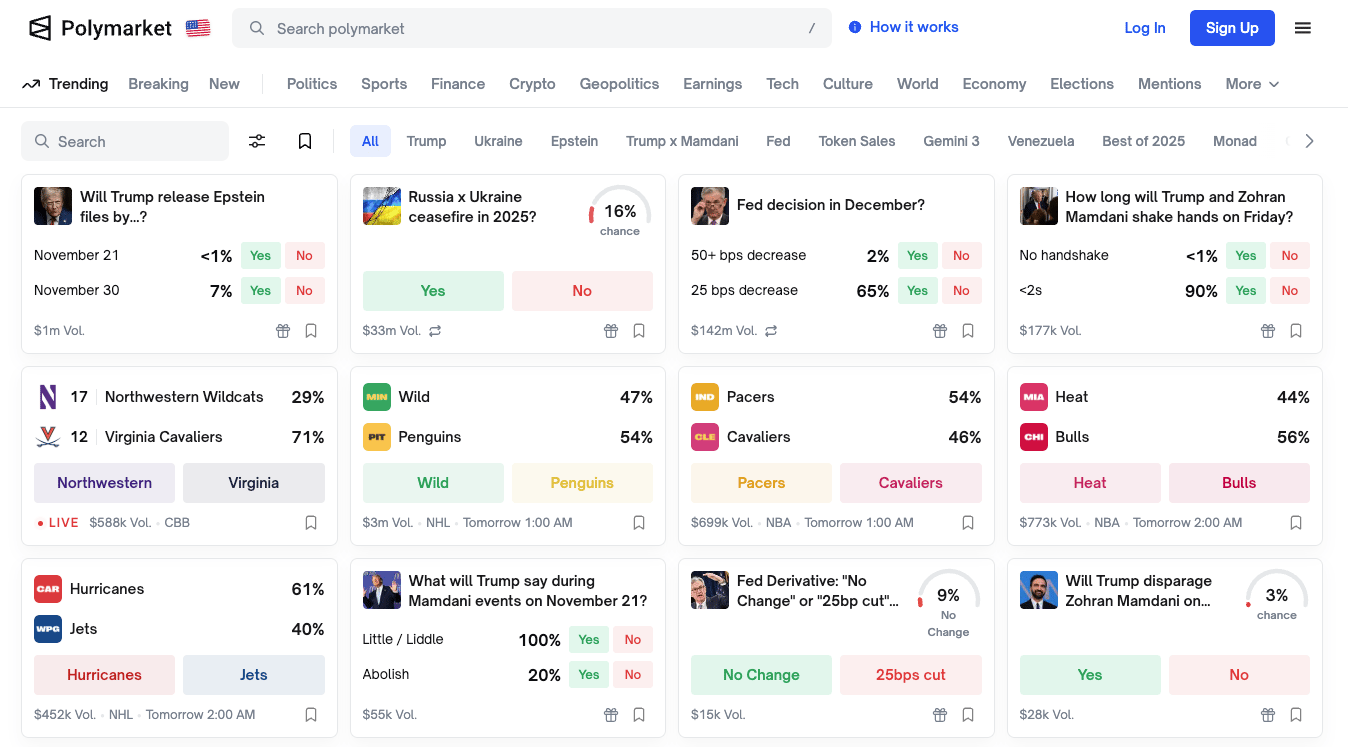

Users can select various predictions on Polymarket’s homepage

This yield capture functions as subsidized customer acquisition. By paying users to hold positions, Polymarket incentivizes capital deposits and market participation. The 4% reward keeps liquidity sticky and ensures markets remain liquid even during low-activity periods.

The strategy only works if the Treasury can consistently generate returns above 4%. Given that USDC can be deployed into low-risk DeFi protocols or traditional money market instruments, this is achievable. But it requires active management and exposes the platform to interest rate risk. If yields fall below 4%, the subsidy becomes a direct cost.

Future revenue: POLY Token (2026 Launch)

The POLY token is the linchpin of Polymarket's long-term monetization strategy. Confirmed by the company's CMO for a 2026 launch, the token will introduce "true utility" through governance and staking mechanisms. More importantly, it will enable the platform to charge fees without alienating users.

Polymarket CMO Matthew Modabber confirmed POLY launch

Here's how it works: Once POLY launches, Polymarket can implement a small transaction fee—likely a fraction of 1%—on trades. That fee gets directed to POLY stakers or accrued to the protocol treasury. Users who stake POLY earn a share of platform revenue, creating a direct incentive to hold and use the token. And Polymarket, as a significant holder of its own token, benefits both from token appreciation and from earning a share of staking rewards.

This model transforms $23.5 billion in volume into a measurable revenue stream. Even a 0.5% take rate would generate over $100 million annually at current volume levels. As volume grows, so does revenue. The token aligns user incentives with platform growth, turning traders into stakeholders.

The timing is strategic. Polymarket is waiting until after the U.S. platform stabilizes to launch POLY. This minimizes regulatory scrutiny during the sensitive re-entry phase. By delaying the token, the company avoids questions about whether POLY is a security and keeps the focus on compliance.

Once activated, token-based fee accrual is expected to contribute 90% or more of future reportable income. It's the singular event required to justify the $9 billion to $15 billion valuation. Without POLY, Polymarket remains a high-volume, zero-revenue platform. With it, the economics flip.

Emerging revenue: Trading fees on the U.S. platform

Polymarket's U.S. exchange, launching in late 2025 or early 2026, will charge a 0.01% fee—100 times lower than Kalshi's 1.2%. At $1 billion in weekly volume, that translates to roughly $100,000 in weekly fees, or $5 million annually. It's modest, but it's a start.

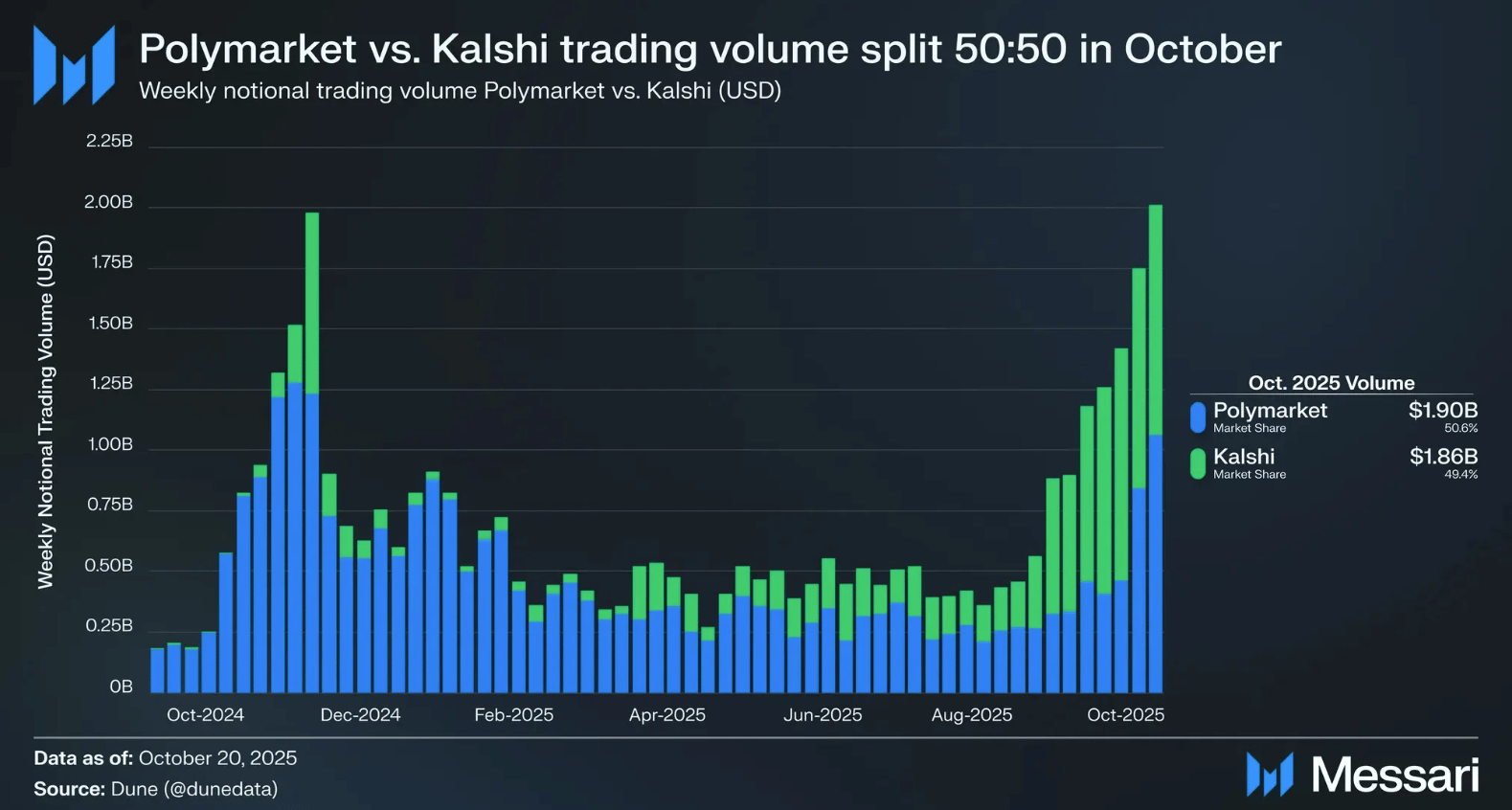

Polymarket and Kalshi have similar trading volumes as of October, 2025

The ultra-low fee is a competitive weapon. Polymarket is using price to undercut incumbents and capture market share. The company has hinted that this rate is promotional and "very unlikely to continue forever." As the platform scales, fees will likely increase.

Even moving to 0.1%—still far below competitors—would generate $50 million annually at current volume. If Polymarket matches Kalshi's volume and fee structure, it could generate hundreds of millions. But the strategy isn't to match Kalshi's fees. It's to use low fees to dominate volume, then monetize through the token.

The global platform remains fee-free for now, but that's expected to change. Once the U.S. exchange proves the model, Polymarket will likely roll out fees worldwide. The company is building toward a harmonized revenue model where fees are low enough to maintain liquidity but high enough to generate meaningful income.

Data licensing and market intelligence

Polymarket's real-time prediction data is valuable beyond the platform. Hedge funds, media companies, and policymakers all want access to crowd-sourced probabilities on events ranging from elections to economic indicators. ICE's $2 billion investment explicitly targets this opportunity.

Polymarket CEO Shayne Coplan and ICE CEO Jeffrey Sprecher

ICE plans to become the global distributor of Polymarket's event-driven data, packaging odds as sentiment factors alongside traditional financial data. This positions Polymarket as information infrastructure, not just a trading venue. The data itself becomes a product.

Data licensing carries near-pure profit margins. Once the data exists, selling it has a low marginal cost. Polymarket could charge for API access, historical data, or custom analytics tools. It could create indices based on prediction market odds or offer derivatives tied to event probabilities.

Polymarket’s cost centers

Polymarket's cost structure is heavily skewed toward regulatory compliance and user subsidies rather than typical tech operations. The company is spending aggressively to achieve market dominance before monetization.

Regulatory and legal expenses

The $1.4 million CFTC fine in 2022 was just the beginning. The real cost of compliance came in July 2025, when Polymarket acquired QCX for $112 million. This wasn't an acquisition of technology or users. It was pure regulatory arbitrage—buying CFTC-registered status to serve American customers legally.

Polymarket CEO announces the acquisition of QCEX in mid-2025

That $112 million is arguably the ultimate Customer Acquisition Cost for the entire U.S. market. It's a one-time fixed expense that unlocks access to the world's largest derivatives market. By incurring this cost, Polymarket mitigates regulatory risk and differentiates itself from unregulated DeFi peers.

Beyond the acquisition, the company faces ongoing compliance costs. It hired former CFTC Chairman J. Christopher Giancarlo as an advisor. It maintains dedicated legal and compliance teams to manage CFTC reporting, market certifications, and geo-blocking technology to prevent U.S. users from accessing the global site.

User incentives and liquidity programs

The 4% annual holding rewards represent millions in annual costs, depending on market positions. This subsidy is funded by the Treasury and functions as heavily subsidized marketing. By paying users to hold positions, Polymarket ensures markets remain liquid even during low-activity periods.

The NHL partnership likely includes licensing fees, adding to the cost of building mainstream credibility. These expenses are strategic. Polymarket is treating liquidity as a moat, using venture capital to build a network effect that competitors can't easily replicate.

This approach mirrors DeFi "liquidity mining" strategies, where platforms pay users to provide capital. The difference is that Polymarket is doing it at scale, with institutional backing, and with a clear path to monetization once the token launches.

Platform development and infrastructure

Polymarket covers Polygon blockchain gas fees via meta-transactions, absorbing costs that users would otherwise pay. It integrates with UMA's Oracle for market resolution, MoonPay and Stripe for fiat onramps, and Coinbase for crypto deposits. Each integration carries development and maintenance costs.

The platform recently added stock index markets, requiring new development work. Smart contract audits and security measures are ongoing expenses.

General and administrative

Operating out of Manhattan means high overhead. Engineering, compliance, legal, and customer support teams all command premium salaries in one of the world's most expensive cities. Polymarket also brought on Nate Silver as an advisor in 2024, adding credibility but also cost.

American statistician Nate Silver joined Polymarket in 2024

Security audits and cyber liability insurance are necessary given the platform's exposure to hacks and exploits. Potential lobbying efforts for favorable regulations add to the expense. M&A integration costs from the QCX acquisition are still being absorbed.

Polymarket’s competitors

Polymarket dominates crypto-native prediction markets with $23.5 billion in volume, but it faces intensifying competition from regulated exchanges, traditional betting platforms, and DeFi challengers. The lines between these categories are blurring as crypto platforms become regulated and traditional platforms add prediction markets.

Kalshi

Kalshi homepage

Kalshi is Polymarket's closest global competitor, with $17 billion in three-year volume compared to Polymarket's $23.5 billion. Both platforms now handle roughly $1 billion in weekly volume, but they've taken different paths to get there.

Kalshi has been CFTC-regulated from inception and works with fiat currencies, giving it legal certainty in the U.S. market. It dominates sports betting, processing $1.1 billion monthly compared to Polymarket's $350 million. Polymarket leads in politics and crypto, with $350 million in monthly politics volume versus Kalshi's $75 million.

The key difference is fees. Kalshi charges an average 1.2%, generating real revenue—$14 million in one October 2025 week alone. Polymarket's 0.01% fee on the U.S. platform is a direct challenge to that model. Both platforms share the NHL partnership, exploiting a federal sports betting loophole.

Kalshi is exploring a $10+ billion valuation, up from $2 billion earlier in 2025. The convergence is clear: Polymarket is adding compliance, Kalshi is adding topics. The winner will be whoever can combine regulatory legitimacy with the broadest market coverage and best user experience.

Traditional betting platforms

Betfair homepage

Betfair, the world's largest betting exchange, operates on a 2-5% commission model. DraftKings acquired Railbird, a CFTC-registered prediction market, in late 2025. These platforms bring massive user bases and marketing budgets that dwarf Polymarket's.

Polymarket differentiates through breadth and zero or low fees. Traditional platforms have trust and simplicity advantages for mainstream users. They're household names with established customer acquisition channels.

FanDuel and others may follow DraftKings into prediction markets, intensifying competition. The question is whether traditional platforms can match Polymarket's liquidity and market variety. Polymarket's crypto rails enable global participation, while traditional platforms are constrained by state-by-state licensing.

Decentralized prediction markets

Betswirl homepage

Augur, the original Ethereum prediction market, failed due to high gas fees and poor UX. Polymarket learned from those mistakes, choosing Polygon for low costs and curating markets for quality. Other players like Limitless Exchange, Zeitgeist, and Manifold remain niche.

SX has accumulated $151.8 million in three-year volume. BetSwirl has $38.4 million. Azuro has $8.7 million. All are dwarfed by Polymarket's $23.5 billion. The liquidity moat creates a "winner-take-most" dynamic. New entrants face a cold start problem—without liquidity, markets don't function.

The future of Polymarket

Polymarket is shifting from a crypto-native prediction app into a regulated event-trading exchange with institutional data ambitions. Its next phase depends on three levers: U.S. market entry, the POLY token, and ICE-backed financial data expansion.

U.S. commercialization begins in 2025 or early 2026 once CFTC processing concludes. The initial focus is sports betting, which gives Polymarket a fast path to mainstream adoption and a stable volume base. A successful launch would anchor the platform inside the world’s largest wagering market.

The POLY token is the company’s economic engine. Without it, Polymarket operates as a zero-take-rate platform. With it, even a 0.5% fee funnels meaningful revenue to stakers and the treasury. The 2026 token design emphasizes governance and staking rewards while avoiding security classification. This structure converts volume into profit while reducing cash incentive burn.

ICE transforms Polymarket from a betting platform into a financial data supplier. The partnership aims to create event-based indices and market-moving probability feeds for institutional investors. If successful, Polymarket becomes an input into Wall Street—not just a consumer app. Tokenization will connect real-world events to traditional financial rails.

Long term, Polymarket aims to formalize event trading as a new derivatives class and position itself as a global probability oracle for businesses and governments. Its trajectory hinges on whether POLY successfully captures revenue from the platform’s soaring volumes. If it does, the $15 billion valuation becomes a floor. If it doesn’t, Polymarket risks becoming a high-profile experiment rather than a new financial market.