Reddit is still widely perceived as "just forums." Yet its annual revenue surged from $666.7M in 2022 to $2.20B in 2025—a 230% increase in three years—and the business flipped from a $484.3M net loss in 2024 to $529.7M net income in 2025. That combination of rapid top-line growth and sudden profitability is counterintuitive for a platform built on pseudonymous text threads and community in-jokes.

The paradox runs deeper. Reddit's content is created almost entirely by unpaid users and policed by volunteer moderators, yet this "free labor" model underpins a 91.2% gross margin and a business now valued on par with Meta on a forward Price-to-Sales basis (~8.3× vs. ~8.2×). One company has 3.58 billion daily active users across a family of apps. The other has 121.4 million. The market is betting on trajectory over scale.

In this breakdown, we'll unpack how Reddit converts pseudonymous community discussions into a multi-layered revenue engine spanning advertising, AI data licensing, and an emerging user economy—plus the cost structure, competitive dynamics, and strategic bets that will define its next phase.

Table of Contents

How Reddit works

Reddit was founded in 2005 by Steve Huffman and Alexis Ohanian as part of Y Combinator's inaugural class. The vision was simple: a user-driven content aggregator—"the front page of the internet."

Steve Huffman and Alexis Ohanian in the early days of Reddit

The company was sold to Condé Nast (Advance Publications) in 2006, gained relative independence starting in 2011, and entered a pivotal chapter when Huffman returned as CEO in 2015. That return marked the shift toward business sustainability and professionalized content moderation. The transformation culminated in March 2024, when Reddit completed its IPO on the New York Stock Exchange at $34 per share, becoming a standalone public company valued at roughly $6.4 billion at pricing.

Reddit IPOd in 2024 under the leadership of its CEO Steve Huffman

Today, Reddit operates as a decentralized network of over 100,000 active subreddits. These are interest-based communities where users publish posts and comments across text, image, video, polls, and chatrooms. The platform serves both logged-in account holders and logged-out visitors arriving via links or search.

Reddit fosters a "pseudonymous intent-based" environment where users engage with topics rather than personalities, creating a "research and discovery" mindset. Internal data indicates 90% of users trust Reddit as a source for learning about new products, and 74% report the platform influences their eventual purchase decisions. This intent-rich context is the foundation of Reddit's advertising and data licensing value.

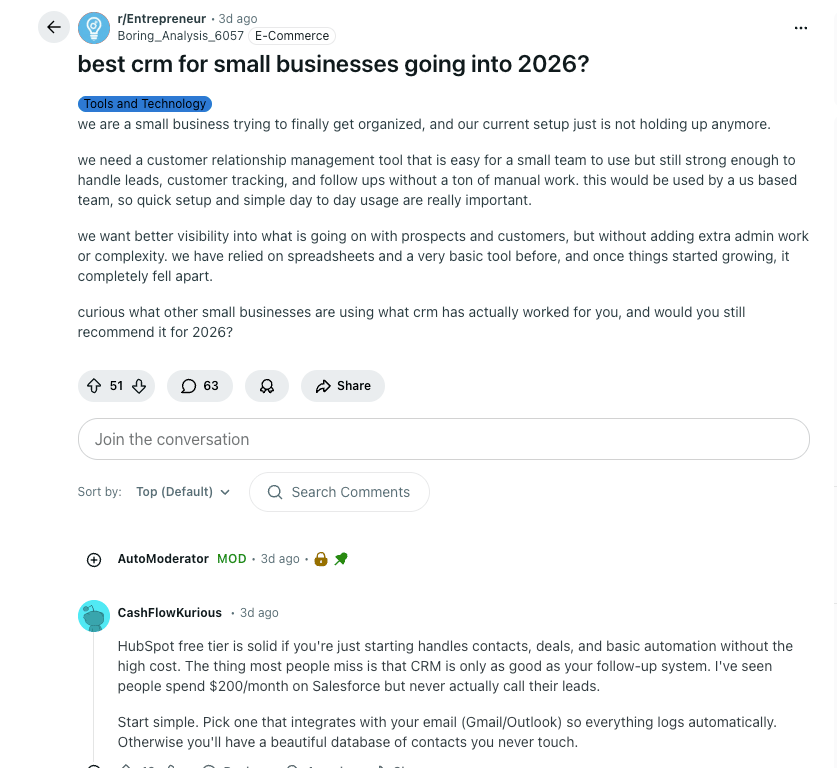

Users often turn to Reddit for product recommendations

Because the Reddit community is notoriously resistant to overt advertising, the company recommends a "Crawl-Walk-Run" framework for brand integration. Brands must first "crawl" by listening to community needs and sentiment, then "walk" by participating in niche discussions without hard-selling, and finally "run" by launching branded subreddits or performance-driven ad campaigns.

Volunteer moderators enforce subreddit-level rules while the company backstops with site-wide Reddit Rules. This is a massive "labor substitution" mechanism that avoids the safety-and-trust payrolls burdening Meta or YouTube.

Subreddit moderators are supported with automated, AI-based bots

On the advertising side, the system relies on first-party interest and context signals, like communities visited or content engagement, rather than personal-identifying cross-site tracking.

Reddit’s revenue streams

Reddit's revenue story is one of explosive growth on a narrow base that is just beginning to diversify. Approximately 94% of 2025 revenue came from advertising, with "Other Revenue"—licensing, subscriptions, and the user economy—comprising the remainder. Total revenue grew 21% (2022→2023), 62% (2023→2024), and 69% (2024→2025).

Year | Total revenue | Advertising revenue | Other revenue |

2022 | $667M | $653M | $14M |

2023 | $804M | $789M | $15M |

2024 | $1.3B | $1.185B | $115M |

2025 | $2.2B | $2.062B | $140M |

Advertising

Advertising generated $2.062B in 2025, representing ~94% of total revenue. Q4 2025 ad revenue alone was $690M, up 75% year-over-year.

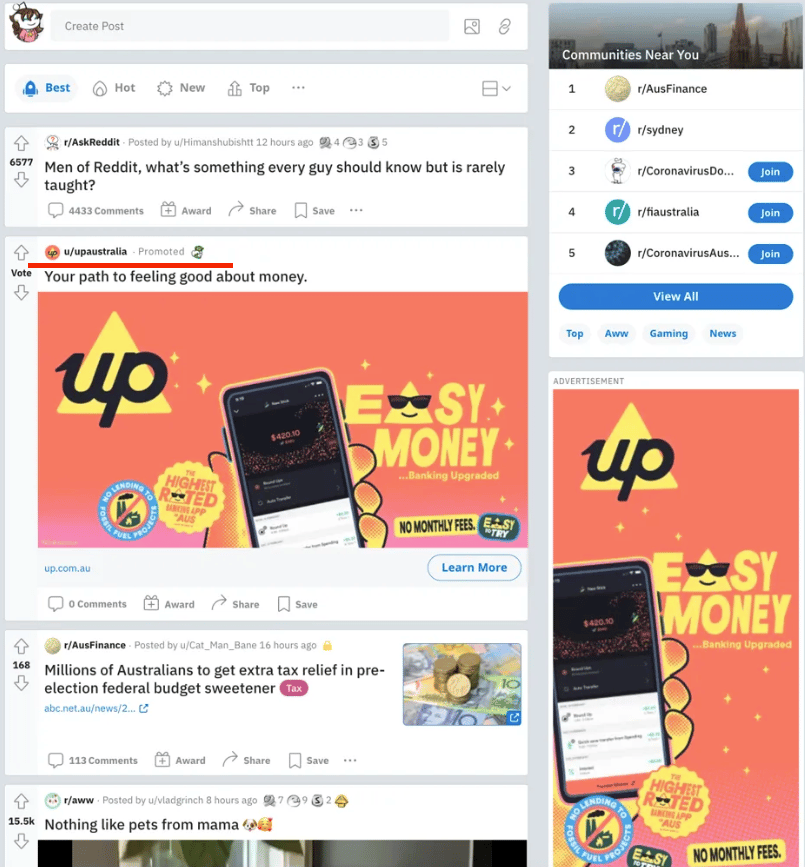

Ads are sold via CPC (click), CPM (impressions), CPV (video views), or fixed-fee arrangements tied to delivery over service periods, often less than 30 days. The system is auction-driven, which means it scales naturally with self-serve demand from SMBs and long-tail performance advertisers.

Ads delivered in a Reddit feed

The 2025 "breakout year" was driven by a massive upgrade in ad technology. The launch of Reddit Max, an AI-powered automated campaign platform, delivered an average 17% reduction in cost-per-acquisition for advertisers. Dynamic Product Ads (DPA) and the expansion of the Conversion API (CAPI) allowed Reddit to compete directly with Meta and Google for e-commerce budgets. Shopping ads saw ROAS improvements of over 75% throughout 2025 due to machine learning model enhancements. Lower-funnel conversion volume doubled.

Unit economics are improving fast. Q4 2025 global ARPU was $5.98, up 42% YoY from $4.21. U.S. ARPU was $10.79, up from $7.04. Rest-of-World ARPU was $2.31, up from $1.67. ARPU is defined as quarterly revenue in a geography divided by average DAU in that geography.

International advertising presents a particularly large runway. International ad revenue grew 78% YoY, but international revenue still represents only ~20% of total. That gap between user growth and monetization is where much of the next wave of revenue will come from.

Data and content licensing

In January 2024, Reddit entered data licensing arrangements with aggregate contract value of $203.0M, with terms of two to three years, and expected a minimum of $66.4M in revenue recognition during 2024.

The strategic asset is Reddit's "human corpus"—over 22 billion comments positioned as a premium dataset for training Large Language Models. Notable agreements include a $60M annual deal with Google for real-time data access. The OpenAI partnership grants API access to bring Reddit content into ChatGPT, though specific financial terms are not fully disclosed in public sources.

The margin profile makes licensing disproportionately valuable. Analysts estimate it accounts for as much as 21% of net profit, despite being a small fraction of total revenue. The reason: nearly zero marginal cost of servicing these contracts. Reddit already hosts the data. Licensing it is almost pure margin.

Subscriptions, user economy, and virtual goods

This revenue stream is not material per both the 2024 and 2025 annual reports. Revenue from Reddit Premium, Reddit Gold, and collectible avatars was explicitly described as "not material for the periods presented" in filings. Because Premium is bundled into "Other Revenue" alongside licensing, its standalone contribution cannot be credibly estimated from public filings.

Reddit Premium users enjoy ad-free browsing and other benefits

The strategic evolution is notable, however. Reddit shut down the "Reddit Vault" and its NFT-based Collectible Avatar shop in January 2026, moving away from Web3-speculative products. The Contributor Program has replaced legacy awards as the primary user monetization mechanism.

The program works like this: eligible users earn cash payouts based on Gold received on their posts and comments.

Program tier | Karma threshold | Payout rate (per 1 Gold) | Cash-out minimum |

Non-contributor | 0–99 | No Payout | N/A |

Contributor | 100–4,999 | $0.009 | $10 |

Top contributor | 5,000+ | $0.010 | $10 |

This creates a "virtuous cycle" of quality content: users are incentivized to contribute high-value information to earn Gold, which increases engagement and provides Reddit with transaction revenue from Gold purchases.

Reddit’s cost centers

Reddit's cost structure reflects a highly scalable ad-and-data platform with a 91.2% gross margin in 2025, up from 90.5% in 2024. But meaningful operating expenses are tied to engineering, infrastructure, go-to-market, and public-company overhead.

Hosting, delivery, and platform operations (cost of revenue)

Cost of revenue was $194.2M in 2025, up 57% YoY from $123.6M in 2024—but growing far slower than the 69% revenue growth, driving gross margin expansion to 91.2%.

This line includes various costs, such as:

payments to third parties for hosting (AWS and GCP)

ad-delivery and targeting costs

payment processing fees

payments to content partners

employee-related costs, including stock-based compensation

The "capital light" profile is striking. Q4 2025 capital expenditures were only $3.2M, or less than 0.5% of revenue, dramatically lower than typical high-growth tech companies where infrastructure costs consume 35–45% of total spend. This reflects Reddit's text-heavy legacy and efficient deployment of LLMs for content understanding and personalization.

More users and more ad delivery drive hosting and third-party service usage, but lower hosting prices partially offset volume increases. The result is a variable-cost dynamic that tilts in Reddit's favor as it scales.

Research and development

R&D expense was $783.1M in 2025, down from $935.2M in 2024 and up from $438.3M in 2023. It is the largest operating expense line.

The 2024→2025 decline is primarily attributed to IPO-related stock-based compensation "catch-up" recognized in 2024, not a reduction in R&D investment. This is crucial context: 2025 profitability is partly normalization, not purely organic margin improvement.

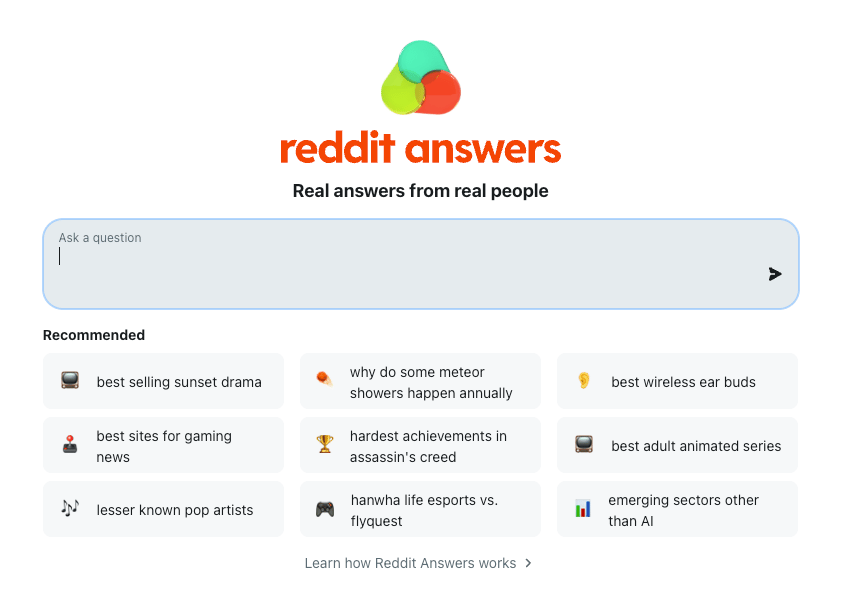

Reddit Answers is an AI-powered answer engine

Investment is focused on AI-driven search (Reddit Answers), machine translation for internationalization across 35 languages, ad tech development (Reddit Max, DPA, CAPI), and the developer platform strategy. The operating leverage signal is clear: headcount grew only 14% in 2025 versus 69% revenue growth, demonstrating that R&D spending is scaling efficiently relative to top-line growth.

Sales and marketing

Sales and marketing expense was $503.9M in 2025, up from $350.6M in 2024, representing approximately 20% of revenue.

This covers sales staff compensation and headcount growth, user and brand marketing expenses including international expansion and product discovery, and scaling advertiser relationships and tooling. This is where Reddit invests in acquiring and retaining users and converting advertiser interest into revenue.

General and administrative

G&A expense was $279.3M in 2025, down sharply from $451.4M in 2024. The decline is primarily attributed to the IPO-related cumulative catch-up for stock-based compensation recognized in 2024. This line includes executive and administrative costs, finance, legal, HR, IT, insurance, professional services, and public-company compliance overhead.

The SBC context matters across all functions. Total stock-based compensation was $387M in 2025, or 18% of revenue, used as a tool to attract top-tier engineering and sales talent. The 2024 SBC total was exceptionally large due to the IPO catch-up, making year-over-year comparisons misleading without this context.

Reddit’s competitors

Reddit competes in two overlapping arenas: attention (user time, engagement, content creation) and monetization (digital advertising budgets and, increasingly, data access and licensing). The company explicitly names Google, Meta Platforms, Snapchat, TikTok, Pinterest, and X as competitors for ad spend.

Platform | 2025 revenue growth | Global DAUq |

69% | 121.4M | |

Meta | 23% | ~3B |

Alphabet | 15% | ~5B |

Snap | 15% | ~430M |

20% | ~500M |

Meta platforms

Meta reported $200.966B revenue for full-year 2025, with 3.58 billion "Family daily active people" as of December 2025. It is the most direct "share-of-wallet" competitor because it operates massive global ad auctions with deep targeting and measurement tooling.

Meta's strengths versus Reddit are clear: massive scale, mature ad infrastructure, broad demographic reach, a long history of performance advertising at global volumes, and identity-based targeting powered by personal data and social graph.

Reddit's strengths versus Meta are different in kind. Community-based, interest-structured discussions create unusually high-intent contexts—product research threads in subreddits, for example, where users are actively seeking recommendations. The voting and moderation system surfaces human-curated content rather than purely social-graph distribution. And Reddit's first-party interest signals avoid cross-site tracking dependencies that have been disrupted by privacy changes like Apple's ATT.

The valuation comparison is striking. Reddit trades at a forward P/S of 8.3×, roughly on par with Meta at 8.2×, despite being ~100× smaller in revenue. That premium reflects investor confidence in Reddit's growth trajectory and AI-ready data moat.

Alphabet (Google)

Alphabet reported $402.836B in revenue for the full year 2025. It is both a competitor and a distribution dependency for Reddit because Reddit traffic is exposed to search algorithm changes, while advertisers allocate budgets across search and social.

Alphabet's strengths versus Reddit include dominant search intent capture with over 90% global search market share, YouTube scale, strong advertiser tooling, and broad reach across the full marketing funnel.

Reddit's value is often "post-search." Users frequently append "reddit" to Google queries to get lived experience and discussion rather than SEO-optimized content. Reddit positions itself as a source of authentic, trusted recommendations and human perspectives.

Reddit content appearing in external search results increased 191% YoY, and 40% of Reddit posts now contain commercial elements. This makes Reddit a direct competitor for search-adjacent intent.

The strategic tension is real. Reddit benefits when search engines surface its pages, driving logged-out traffic and new user acquisition. But it faces material business risk when search ranking methods change, which the company flags explicitly in its risk factors. Adding another layer of complexity, Google is also a licensing customer—the $60M annual deal for real-time data access creates a competitor-customer dynamic that few other companies navigate.

Snap

Snap reported $5.931B revenue for full-year 2025, up 11% YoY, with 474M DAU for Q4 2025, Q4 net income of $45M, and a subscription product (Snapchat+) that reached 24M subscribers.

Snap is the closest "peer-scale" competitor. It relies heavily on advertising while building subscription and other revenue streams, and operates at a revenue scale closer to Reddit's than Meta or Alphabet.

Snap's strengths versus Reddit include camera and AR-oriented product surfaces and ad formats powerful for certain verticals like beauty, fashion, and entertainment. Snap also has a large global daily active user base of 474M versus Reddit's 121.4M and established subscription revenue via Snapchat+.

Reddit's strengths versus Snap center on depth. Threaded discussion and community structure supports deeper research intent and long-tail topic communities. Content is monetizable through both ads and data licensing, a revenue stream Snap lacks entirely. And Reddit's ARPU growth rate of 42% YoY significantly outpaces Snap's revenue growth of 11% YoY, suggesting faster monetization improvement per user.

The future of Reddit

Reddit's strategic roadmap is built on four pillars: international expansion, AI-powered product innovation, advertising automation, and capital discipline. Each carries both opportunity and risk.

Internationalization via machine translation is the most obvious growth lever. International revenue grew 78% YoY in 2025 but still represents only ~20% of total revenue, highlighting a massive runway. Reddit is using LLMs to translate its English-language corpus into 35 languages, enabling content delivery in markets where it previously had little presence.

Reddit Answers and agentic search represent a bet on changing how people use the platform. Reddit is testing an AI-powered search and chat feature that provides synthesized answers to complex queries, including media beyond text. This targets the 80M people who already use Reddit's search feature weekly and represents a shift toward "daily utility" rather than social browsing. If successful, it positions Reddit as a direct alternative to Google for certain query types—particularly those where users already append "reddit" to their searches.

Advertising automation and performance deepening will drive near-term revenue. The company is expanding AI-driven ad tools—Reddit Max, DPA, CAPI—to capture more performance and lower-funnel budgets.

Capital allocation is maturing. Reddit announced its first-ever $1B share repurchase authorization in early 2026, supported by $2.5B in cash and marketable securities and $684.2M in free cash flow for full-year 2025. This signals management confidence in sustained cash generation post-IPO normalization.

The binding constraint across all of these initiatives is platform integrity. Reddit's greatest long-term challenge is maintaining the "moderator-user" trust that underpins the entire system.

Dependence on volunteer moderators, the need to scale moderation tooling, and the perpetual tradeoff between ad load and community health will determine whether Reddit can sustain its growth or face the community backlash. The forums built the business. Keeping them healthy is the hardest part of growing it.