SpaceX has established its dominance with the revolutionary Falcon rockets. But the company now generates the majority of its $13-14 billion annual revenue from Starlink satellite internet subscriptions, a complete reversal of its original business model. The quest to make humanity multi-planetary is funded through providing internet to rural customers on Earth.

Such financial architecture represents more than just diversification. It's a carefully engineered system where high-frequency internal launches serve to iterate on the rocket design, while recurring subscription revenue provides the crucial cash flow independence.

The result is unprecedented freedom from external funding cycles. SpaceX gets to pursue decade-long developmental goals like Starship while maintaining operational excellence. And by late 2024, SpaceX's private valuation reached $350 billion, making it one of the most valuable private companies in history. Let's dive into this incredible story.

Table of Contents

How SpaceX works

SpaceX was founded in 2002 by Elon Musk with the explicit goal of enabling human life to become multi-planetary. Musk's enterprise has gradually transformed into a vertically integrated manufacturer that controls nearly every aspect of its supply chain.

Elon Musk launched SpaceX in 2002

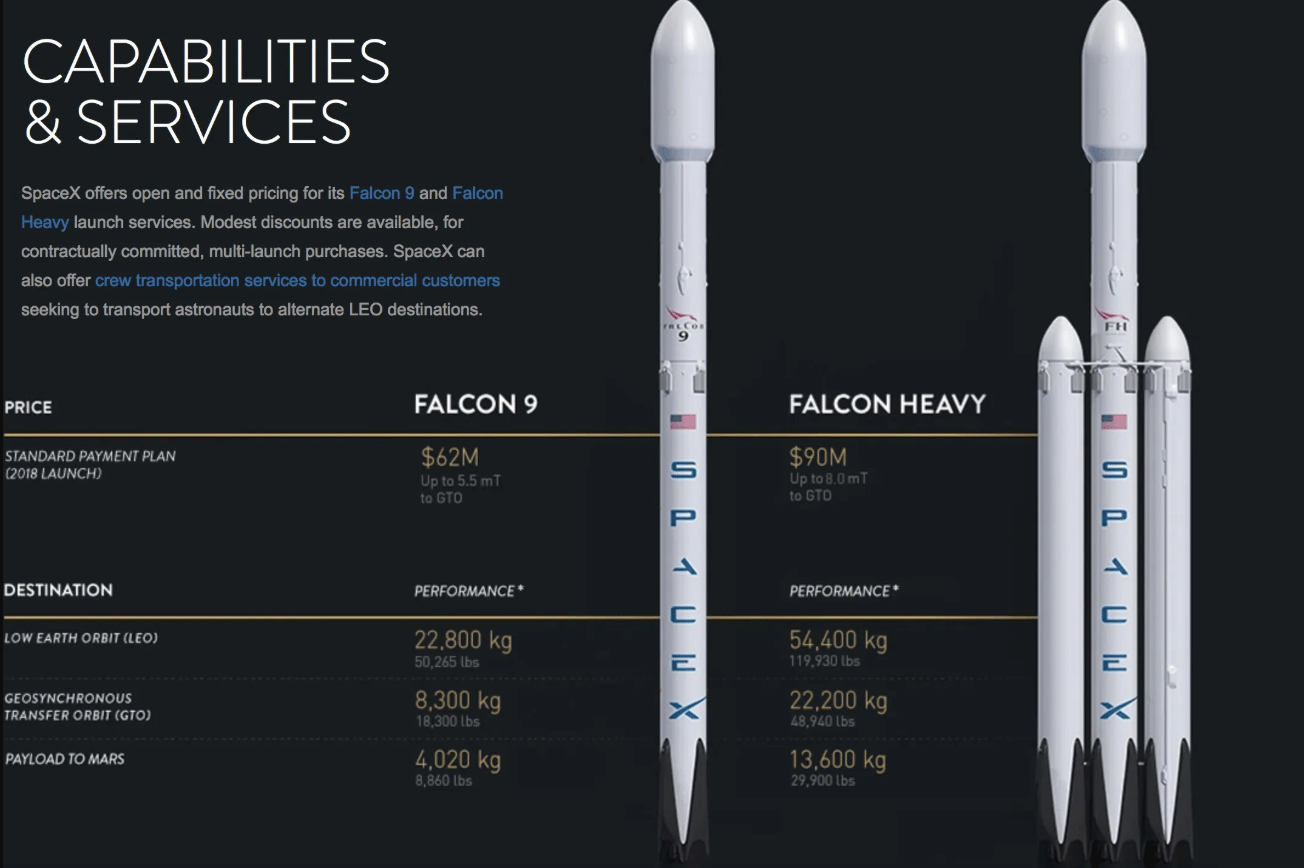

The company's core offerings center on two primary product families that work in harmony. Falcon 9 and Falcon Heavy launch services provide rapid, reliable, and cost-effective transport to orbit, while Starlink operates as a global satellite internet constellation serving 4.6 million users as of 2024. This dual approach creates unique operational advantages that competitors struggle to replicate.

Falcon 9 and Falcon Heavy rockets

SpaceX's value proposition rests on reusability economics that have revolutionized the industry. Falcon 9 first stage refurbishment costs dropped from $13 million to $1 million over five years, enabling the company to offer launches at approximately $67 million while maintaining healthy margins. Starlink operates on a Software-as-a-Service model where the marginal cost of serving additional users is minimal once the satellite infrastructure is deployed.

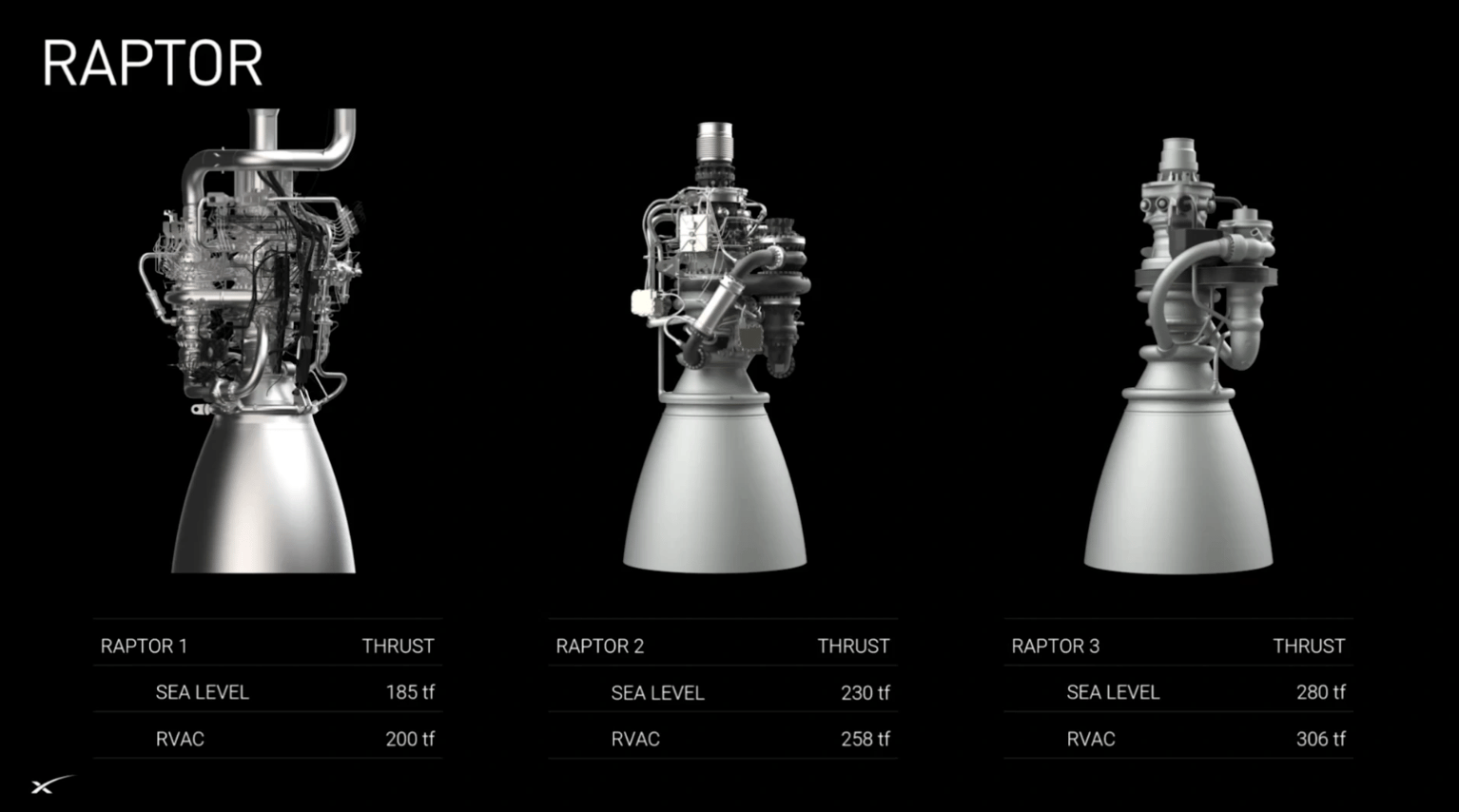

The company's key differentiator lies in extensive vertical integration, unlike traditional aerospace subcontracting layers. SpaceX designs and manufactures Raptor engines, Falcon rockets, Starlink satellites, and user terminals in-house. This approach extends to its unique operational model where 66% of Falcon launches in 2024 were internal Starlink missions.

The evolution of SpaceX’s Raptor engine

SpaceX's infrastructure spans from Starbase in Boca Chica, Texas (a $3 billion investment) to manufacturing hubs in Hawthorne, McGregor, and Redmond. Critical government partnerships provide stable revenue foundations through NASA's Commercial Resupply Services and Commercial Crew Transportation contracts, plus Space Force's National Security Space Launch program.

SpaceX’s revenue streams

SpaceX's financial transformation is evident in its revenue evolution from $8.7 billion in 2023 to an estimated $13.3-14.2 billion in 2024. The shift shows Starlink now dominating at 58-62% of total revenue, while launch services contribute 30-32%.

Revenue Stream | 2023 Estimate | 2024 Estimate | 2024 Share | YoY Growth |

Starlink Services | $4.2-4.4B | $7.7-8.2B | 58-62% | 83-86% |

Launch Services | $3.5B | $4.2B | 30-32% | 19% |

Government/ Other | ~$1.0B | ~$1.1-1.3B | 8-10% | Variable |

Starlink subscription and service fees

Starlink generates an estimated $7.7-8.2 billion in 2024, up from $4.2-4.4 billion in 2023. This explosive 83-86% growth was driven by subscriber expansion from 2.3 million users in 2023 to 4.6 million in 2024, with projections heading toward 5 million by late 2025.

The business operates on tiered pricing that maximizes revenue across diverse customer segments. Residential service typically costs $120 per month for standard plans, with Residential Lite options at $80 per month and subsidized rates as low as $15 per month in select regions.

Higher-tier services drive substantially better unit economics. Fixed-site business customers pay $65-540 per month based on priority data allowances, while maritime services command several thousand dollars monthly. In 2024, Starlink connected over 75,000 vessels, including 300 cruise ships, under these premium contracts. The Average Revenue Per User (ARPU) varies dramatically: residential customers generate approximately $2,000 annually, maritime clients around $34,000 per year, and aviation customers roughly $300,000 annually.

Starlink satellites can sometimes be seen in the night sky

Starlink reached EBITDA-positive status in 2024 with projections of $2 billion in free cash flow by the end of 2025. Analysts project the service will achieve 25% gross margins by 2026 as the constellation matures and hardware costs per user decline. This recurring revenue model provides the financial foundation for SpaceX's long-term development programs.

Starlink hardware sales

Hardware sales are projected to contribute approximately $1.3 billion in 2025. The standard residential kit costs $599, while high-performance versions reach $2,500, but these prices often represent deliberate subsidies below manufacturing costs.

Starlink terminal receives and transmits data

SpaceX's hardware strategy functions as customer acquisition cost optimization. The company frequently sells terminals at or below production cost—initially around $3,000 per unit, reduced to under $1,500 by 2021—to secure profitable long-term subscription relationships.

The underlying satellite infrastructure requires continuous capital investment. Advanced Starlink V2 satellites cost an estimated $1-1.5 million per unit, with thousands needed for constellation maintenance given the approximately 5-year replacement cycle. This creates a substantial ongoing manufacturing expense that SpaceX funds through subscription revenue growth.

Government and defense contracts

Government contracts provide crucial revenue stability and high-margin income streams that insulate SpaceX from commercial market volatility. NASA alone contributes approximately $1.1 billion annually through multiple program streams that have evolved from early development contracts to operational services.

NASA's Commercial Resupply Services program, with an obligation cap up to $14 billion, and Commercial Crew Transportation contracts valued at $4.93 billion total, generate substantial recurring revenue. Crew transport economics are particularly lucrative, with estimated seat prices ranging from $55-72 million per astronaut. This pricing is significantly below historical costs and yet very profitable for SpaceX.

The U.S. Space Force provides another major revenue pillar through the National Security Space Launch program. SpaceX was awarded $845 million for seven Lane 2 contracts in 2025, plus $733 million in Lane 1 contracts in 2024. These defense launches were primarily responsible for the 19% year-over-year growth in the launch segment, with 17 government missions conducted in 2024.

Emerging opportunities include Starshield, a classified satellite network for military use that leverages Starlink technology for defense applications. This program represents potential expansion into high-value government services beyond traditional launch contracts.

Commercial launch services and rideshare

Commercial launch services generated $4.2 billion in 2024, up from $3.5 billion in 2023, despite representing a smaller percentage of total revenue due to Starlink's explosive growth. The Falcon 9 maintains its benchmark pricing at approximately $67 million per launch, sustaining the industry's lowest cost-per-kilogram ratio.

Falcon 9 rocket launch

SpaceX's Rideshare program democratizes access to space by offering capacity starting at $325,000 for 50kg payloads to Sun-Synchronous Orbit. This volume-based pricing model attracts customers who might otherwise use emerging micro-launch competitors.

The strategic trade-off of aggressive pricing ensures perpetually full launch schedules. High-frequency operation—with 134 orbital missions in 2024—creates a competitive moat that competitors struggle to match due to lower launch cadences and higher per-flight costs.

SpaceX’s cost centers

SpaceX's cost structure reflects massive strategic investments aimed at realizing its long-term vision. The company's expenses are characterized by next-generation development programs, constellation deployment, and the infrastructure necessary to support unprecedented launch cadence.

Starship research, development, and testing

The development of the next-gen launch vehicle, called Starship, represents SpaceX's single largest capital commitment, with an estimated total R&D investment of approximately $10 billion. As of early 2024, the company had invested between $5-8 billion in the program, including initial Starbase construction and infrastructure development.

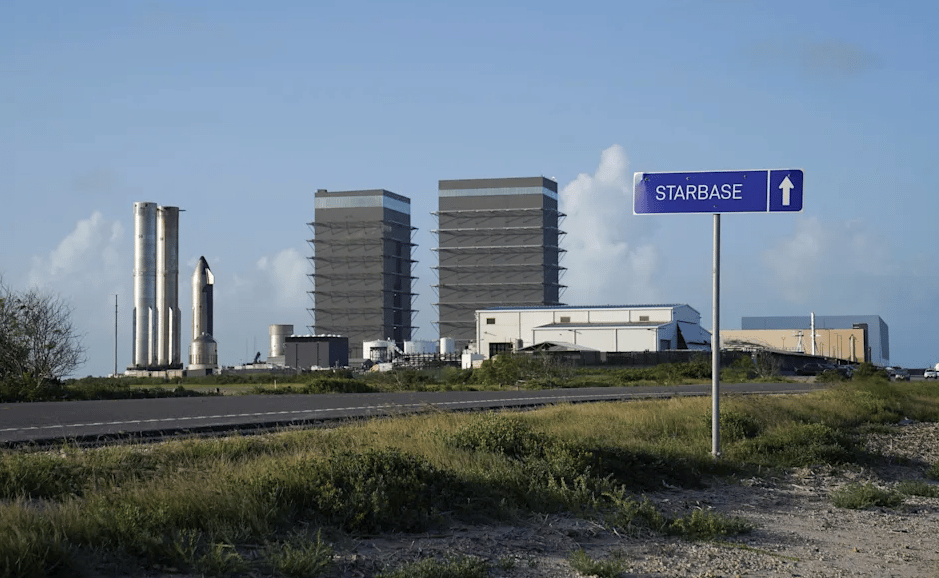

The Starbase facility is continuously expanding

This privately funded ambition required significantly less capital than NASA's $24 billion Space Launch System. The NASA Human Landing System contract provides crucial offset funding, with over $3 billion obligated out of a $4.0 billion award for the Starship lunar variant.

The high R&D investment is justified by extremely low operational cost targets. Estimates project Starship's marginal cost per flight at $2-4 million once operational, enabling customer pricing above $10 million per flight to recoup development costs while maintaining substantial margins.

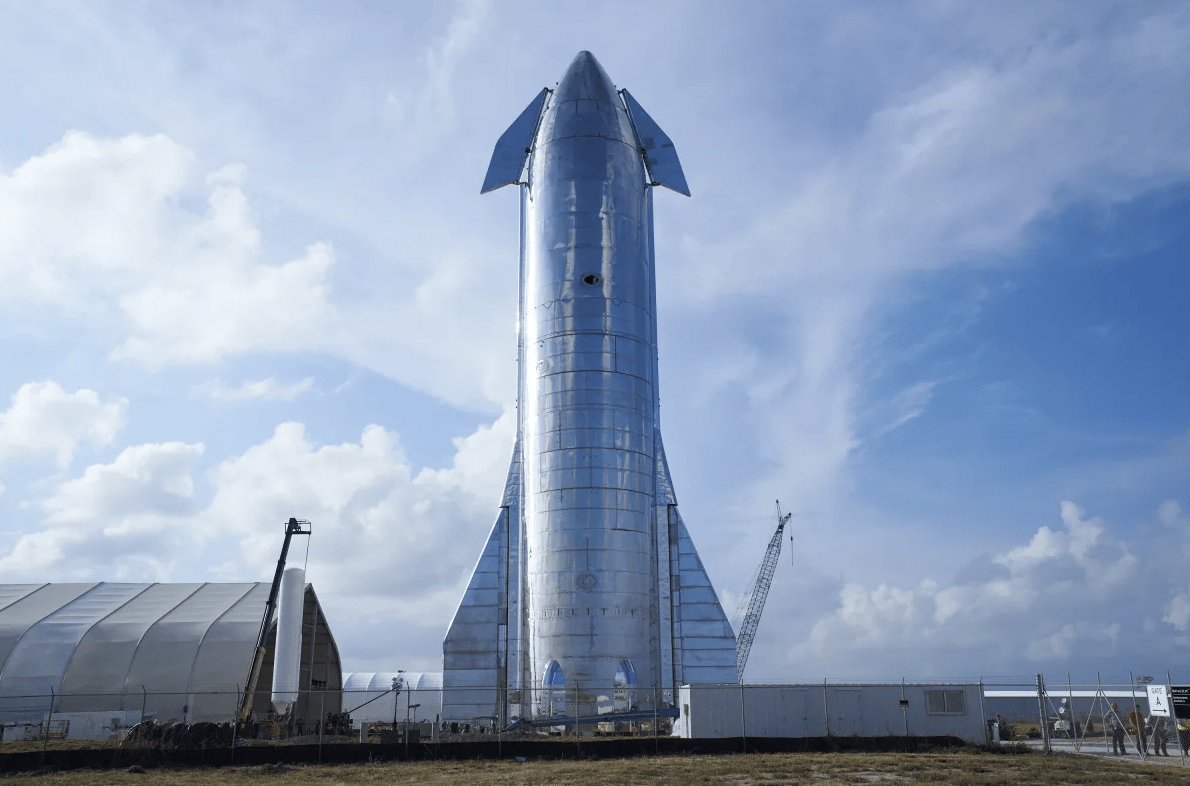

Starship is the next-gen launch vehicle

Starlink deployment and manufacturing

The Starlink constellation requires continuous massive capital expenditure for satellite production, launch, and ground infrastructure. Advanced V2 satellites cost between $1-1.5 million per unit, with thousands required to maintain network coverage through the estimated 5-year replacement cycle.

SpaceX invests the equivalent of a large portion of its launch fleet into Starlink deployment. In 2024, 89 Falcon launches were dedicated Starlink missions—representing billions in internal launch capacity devoted to constellation expansion.

Terminal subsidies create ongoing customer acquisition costs, with SpaceX often subsidizing $500-1,000 per residential kit to build a subscriber base. Ground infrastructure, including global gateway networks and data center connectivit,y adds additional fixed costs for network operations.

Launch operational costs (Falcon fleet)

Operational efficiency gains through reusability have dramatically reduced launch costs. Falcon 9 first stage refurbishment costs dropped from approximately $13 million to roughly $1 million over five years, directly resulting from high-frequency operational cycles enabled by internal Starlink launches.

This continuous cost reduction allows SpaceX to maintain aggressive pricing at $67 million per launch while ensuring healthy margins. The 89 internal Starlink missions in 2024 function as both necessary constellation deployment and valuable testing mechanisms that drive operational improvements.

Infrastructure and capital expenditure

SpaceX maintains high capital expenditure to support future manufacturing goals, including a $250 million investment in the "Gigabay" facility at Starbase. This infrastructure is designed to achieve unprecedented production rates of up to three Starships per day, essential for realizing full reusability and low marginal cost structures.

Additional infrastructure includes launch complexes at Cape Canaveral and Vandenberg, plus drone ships for recovery operations. These investments enable the high operational tempo that underpins SpaceX's cost advantages and competitive positioning.

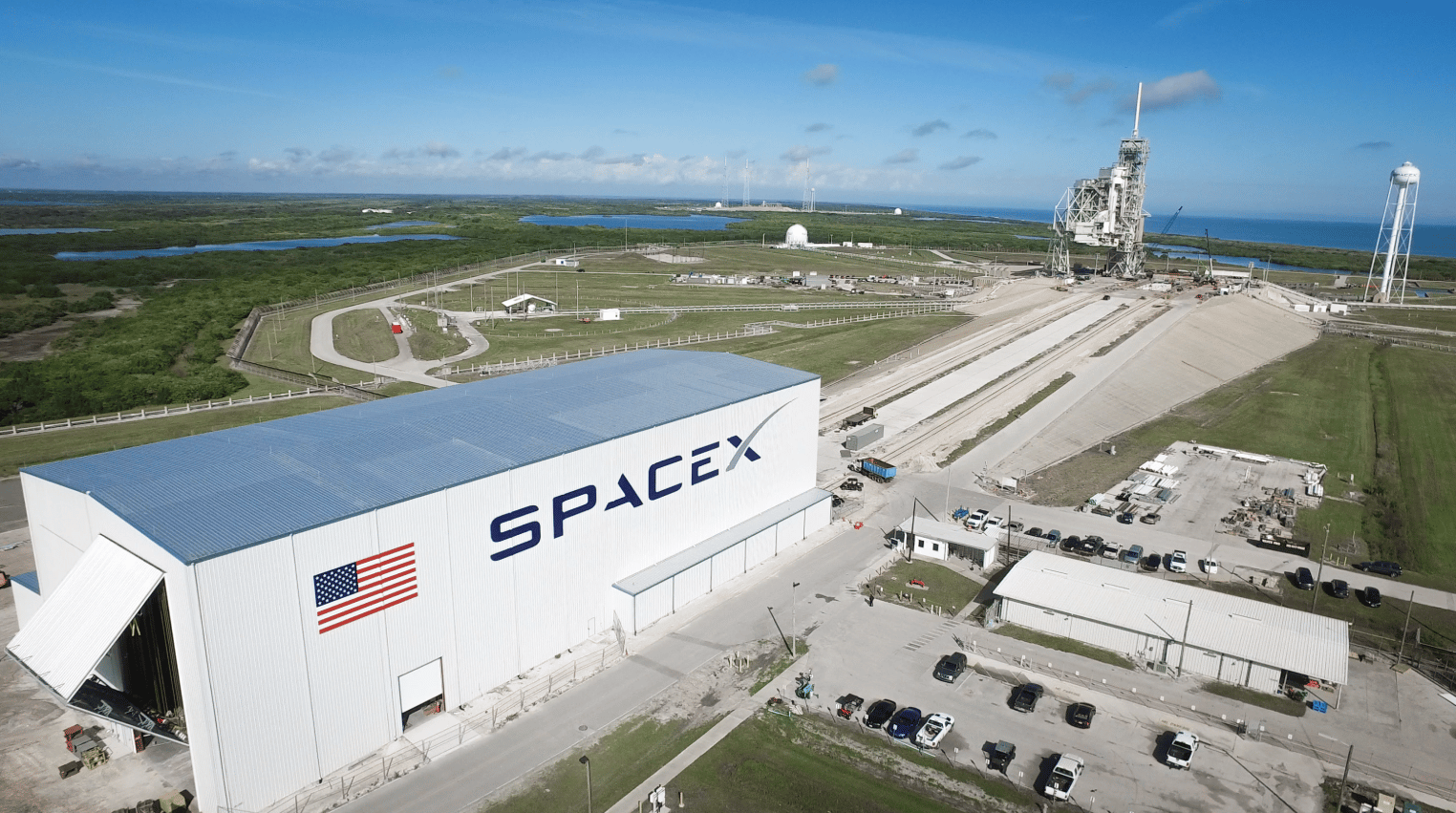

SpaceX launch facilities at Cape Canaveral

SpaceX’s competitors

SpaceX faces competition across two distinct markets: the established government launch sector and the emerging LEO (Low Earth Orbit) satellite broadband market. Its dominance has forced both legacy providers and new entrants to accelerate the development of competitive systems.

United Launch Alliance (ULA)

ULA represents the traditional aerospace model with lower launch rates, higher costs, and heavy government subsidies. Historical pricing of $100-400 million per mission contrasts sharply with SpaceX's $67 million Falcon 9 benchmark, forcing ULA to develop the Vulcan Centaur as a more cost-competitive response.

The U.S. government maintains ULA contracts based on strategic requirements for launch provider redundancy, ensuring critical national security assets can reach space even if one provider faces systemic failure. This policy provides ULA with a guaranteed market share despite cost disadvantages.

ULA had zero launches in 2023 during its transition to Vulcan, while SpaceX flew 98 missions. Even with Vulcan's debut, ULA's rumored pricing of $80-100 million per launch struggles against SpaceX's proven cost structure and operational tempo.

Blue Origin

Blue Origin represents the most significant long-term competitive threat, backed by Jeff Bezos's wealth and pursuing similar reusability goals. New Glenn's inaugural flight in January 2025 marked Blue Origin's entry into orbital launch, though the booster recovery attempt failed.

Blue Origin secured 7 missions worth $2.3 billion in the NSSL Phase 3 program, providing guaranteed government revenue once New Glenn achieves certification. The company also holds lucrative contracts for Amazon's Project Kuiper constellation, with up to 27 New Glenn launches contracted.

Blue Origin's patient, well-funded approach contrasts with SpaceX's rapid commercialization pressure. However, the company lacks operational experience with zero orbital launches until 2025, compared to SpaceX's hundreds of successful missions.

Amazon Project Kuiper

Amazon represents the most potent financial threat in satellite broadband connectivity, committing over $10 billion to Project Kuiper with 92 launches secured across multiple vendors. Amazon's multi-vendor launch strategy offers supply chain redundancy as a key selling point against Starlink's vertically integrated system.

Amazon's deep integration with existing logistics and cloud infrastructure provides potential competitive advantages in enterprise markets. However, the company faces the challenge of building a constellation scale while SpaceX already operates over 7,100 satellites serving millions of users.

OneWeb (Eutelsat Group)

OneWeb focuses on high-margin government and enterprise solutions rather than mass consumer markets. The European company offers fixed pricing, Service Level Agreements, and dedicated bandwidth packages optimized for mission-critical communications.

With 648 satellites compared to Starlink's 7,100+, OneWeb operates at a much smaller scale but targets premium services where reliability and dedicated support command higher prices. This positioning avoids direct competition with Starlink's consumer focus while serving specialized market segments.

The future of SpaceX

SpaceX is transforming Starlink into a global telecommunications infrastructure provider while achieving Starship operational status to enable Mars colonization. The convergence of these goals will determine the company's ability to maintain independence while pursuing humanity's multi-planetary future.

Starlink's Direct-to-Cell expansion represents a shift from specialized hardware users to billions of existing smartphone users. The $17 billion EchoStar spectrum acquisition enables satellite connectivity on unmodified mobile phones, potentially unlocking $20-150 billion in annual revenue by 2030. This would establish SpaceX as a crucial global telecommunications infrastructure provider.

The path to profitability accelerated with Starlink achieving EBITDA-positive status in 2024. The anticipated Starlink spin-off IPO, valued between $30-300 billion, would provide liquidity for early investors while injecting massive capital into SpaceX for Starship development.

Strategic bets extend beyond core operations into fusion energy partnerships and AI-powered scientific discovery. These investments position SpaceX as both a market leader in space transportation and a contributor to solving complex societal challenges. The company's financial projections suggest revenue potentially exceeding $15 billion by 2025.

The ultimate test will be SpaceX's ability to maintain cost leadership through reusability while expanding from specialized aerospace markets to serving billions of global consumers. Success would create an unprecedented combination of transportation infrastructure and telecommunications services, funding humanity's expansion beyond Earth and revolutionizing connectivity on our home planet.