Temu loses an estimated $30 on every order it ships. Yet in 2024, the platform generated $70.8 billion in gross merchandise volume, making it the fastest-growing e-commerce marketplace in history. This isn’t a broken model. It’s a calculated bet on scale, underwritten by PDD Holdings’ $34.8 billion revenue engine.

The losses are intentional. Temu sells $1–$3 products with free international shipping by absorbing costs that competitors can’t. Since launching in 2022, it has reached roughly 416 million monthly active users worldwide while posting annual losses estimated between $588 million and $954 million.

This is blitzscaling pushed to the extreme with market capture as the goal. Owned by Chinese e-commerce giant PDD Holdings but registered in Boston, Temu is funding an aggressive land grab across Western markets. Prices are set low enough to be irrational for rivals, loyalty is built at scale, and margins are deferred.

In this breakdown, we examine how Temu’s economics work, where the money comes from, and whether this loss-making machine can ever flip the switch to profit.

Table of Contents

How Temu works

Temu launched in September 2022 as the international arm of PDD Holdings, a company established in China in 2015 as Pinduoduo. The strategic decision to register Temu in Boston, Massachusetts, rather than China serves a clear purpose: managing perception.

Colin Huang, the founder of Temu and the Chinese e-commerce platform Pinduoduo

Despite its U.S. registration, Temu's operations, supply chain, and ownership remain firmly rooted in China. The Boston headquarters is a calculated move to build consumer trust and navigate increasing geopolitical scrutiny around data privacy and supply chain transparency, particularly compliance with the Uyghur Forced Labor Prevention Act.

Temu operates as a broad marketplace offering everything from electronics and home goods to toys and accessories. The platform connects consumers directly with Chinese manufacturers through what it calls a Consumer-to-Manufacturer (C2M) model, bypassing traditional wholesalers and retailers entirely.

The user experience is engineered for maximum engagement and impulse purchases. Temu deploys aggressive gamification tactics, like spinning discount wheels, countdown timers, and limited-time flash deals. The platform's algorithms personalize shopping catalogs based on user data and purchase history. Users report receiving over 100 contacts within three weeks through push notifications, email, and SMS.

Temu uses spinning discount wheels and other tactics to encourage purchases

At the operational core sits Temu's zero inventory holding strategy, powered by its Next-Generation Manufacturing (NGM) system. Advanced algorithms analyze consumer behavior to give manufacturers precise insights into what to produce and when. This minimizes overproduction, reduces inventory risk, and lowers manufacturing costs.

The logistics infrastructure supporting this model is equally critical. Temu's "Factory-to-Door" approach consolidates products at the source, typically using air freight from Guangzhou warehouses. Through bulk consolidation and unified packaging, the company achieves cross-border shipping costs as low as $0.60 to $0.70 per parcel. For U.S. distribution, Temu coordinates with freight forwarders and local carriers like USPS and UPS.

Historically, this model relied heavily on the U.S. $800 de minimis exemption — a century-old trade rule allowing foreign goods valued under $800 to enter duty-free without formal customs declarations. In 2024 alone, over 1.36 billion packages entered the U.S. from China under this exemption. For Temu, this was foundational infrastructure that enabled ultra-low pricing by systematically avoiding tariffs that traditional importers had to pay. But the de minimis exemption in the US no longer applies as of August 29, 2025.

Temu’s revenue streams

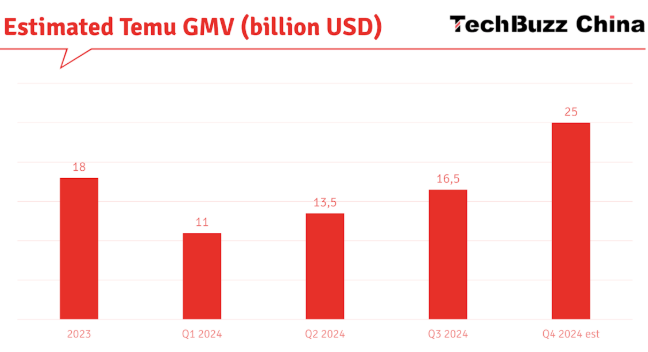

Temu's financial trajectory has been explosive. Gross Merchandise Volume surged from $290 million at launch in late 2022 to an estimated $15.1-18 billion in 2023, reaching nearly $70 billion in 2024. The flagship domain temu.com alone generated $53.9 billion in revenue in 2024. This growth is entirely underwritten by PDD Holdings, which generated $34.8 billion in revenue in 2023.

Marketplace commissions and take-rate

Temu's primary revenue mechanism is fees charged on sales facilitated through its platform. The structure is complex and often deliberately opaque. Some sources report referral fees ranging from 2% to 5% of the sale price, while industry analysis suggests the platform's overall take-rate — the total margin Temu captures from each transaction — ranges from 5% to 20%, with some estimates reaching 15% to 30% depending on product category.

Temu’s gross merchandise volume has reached nearly $70 billion in 2024

The disparity between reported fees and actual take-rates reveals how Temu's model works. Given the estimated $30 loss per order, a 2% to 5% commission wouldn't cover logistical costs, let alone massive marketing subsidies. The higher take-rate estimates likely reflect the total margin Temu retains, which includes compulsory logistics and fulfillment costs bundled into seller agreements.

Temu operates what's effectively a Fulfillment-by-Temu model. The platform controls final consumer pricing and manages the entire fulfillment process. This control allows PDD Holdings' capital to absorb external subsidies while Temu ensures sufficient transaction revenue flows through the marketplace. Many sellers operate at break-even or slight losses, accepting razor-thin margins in exchange for volume and access to international markets.

Advertising and sponsored listings

Temu's nascent internal advertising ecosystem represents a critical future revenue stream. Similar to Amazon's model, the platform allows merchants to purchase sponsored listings that boost product visibility in search results or curated collections. Sellers pay based on cost-per-click (CPC) or cost-per-impression (CPM) metrics.

The value proposition is compelling. With approximately 1.7 billion monthly visits to temu.com, advertising inventory is extremely valuable. As the platform achieves customer retention and reduces external customer acquisition spending, internal ad revenue is positioned to become a high-margin, highly scalable stream that will be vital in compensating for current operating losses.

Right now, advertising revenue is a small fraction of Temu's total income. The company has prioritized subsidizing prices over extracting ad dollars. But as more sellers join and compete for visibility, advertising bids will increase. The sheer scale of Temu's traffic makes this inevitable.

Data monetization and payment processing

Temu's collection and utilization of extensive user data represents value that's often monetized indirectly. The data provides real-time insights necessary for the NGM system to function optimally, predicting demand and reducing manufacturing costs for suppliers. This optimization ensures product-market fit and minimizes inventory risk, which is crucial for the platform's low-cost structure.

Temu offers a range of payment options that generate processing revenue

Additionally, Temu generates revenue by managing payment processing, either directly or by factoring in costs incurred from third-party payment providers like PayPal (typically around 2.9% plus $0.30 per transaction) into the total fee structure charged to sellers. While these aren't massive revenue drivers, they contribute to the overall economics of each transaction.

Temu’s cost centers

Temu's business model is textbook blitzscaling — deploying capital strategically to purchase market share rapidly, accepting significant short-term losses in pursuit of long-term dominance. The operation is currently unprofitable, with annual losses estimated between $588 million and $954 million.

Marketing and customer acquisition

Marketing and customer acquisition represent Temu's single largest expenditure category. The company ran massive user-acquisition campaigns across the U.S., Europe, and Latin America during 2023 and 2024. In 2023 alone, advertising and marketing spend was estimated between $2 billion and $3 billion.

The scale of this spending is staggering. For the 2024 Super Bowl, Temu ran three 30-second spots at an estimated cost of $21 million in airtime alone. The company followed up with over $15 million in related coupon giveaways tied to the Super Bowl campaign. This was part of a sustained blitz across every major channel.

Temu’s ads for the 2024 Super Bowl had “Shop Like a Billionaire” tagline

Temu blanketed social media with ads on TikTok, Instagram, and YouTube. It paid influencers to promote Temu hauls. It bid on over 900 app store keywords to ensure it topped search results. The company offered new users steep sign-up bonuses, sometimes "$50 off first $100" or three free gifts for joining via referral.

Temu runs a global affiliate and influencer program

The strategic gamble is that Customer Lifetime Value will eventually justify these massive upfront investments. If users stick around and make 30 purchases per year at $50 average order value — Temu's reported internal goal — the initial acquisition cost becomes justifiable. But if users make one or two trial purchases and disappear, this spending becomes catastrophic capital burn.

Shipping and logistics subsidies

Temu's commitment to heavily subsidize shipping creates substantial expenses. While the company achieves ultra-low cross-border freight costs of $0.60 to $0.70 per parcel through consolidation, last-mile delivery remains costly in Western markets.

Temu aims to push local service providers to maintain last-mile costs at approximately $1 per order, plus an additional $1 subsidy in early stages, setting an internal target of $2 per delivery. This places extreme cost pressure on logistics partners but is non-negotiable for maintaining the platform's price promise to consumers.

Temu has partnered with DHL as one of its logistics partners in Europe and the Middle East

The economics are brutal. Sending even a small package from Temu's Guangzhou warehouse to a U.S. customer costs around $14 in postage and handling. Temu and its logistics partners absorb most of this — roughly $9 to $10 per shipment on average. If a user only spent $5 on an order, Temu might be eating $9 in shipping loss right there.

Regulatory changes pose additional threats. The closure of the de minimis exemption eliminates a massive structural advantage. New regulations in Europe, such as a proposed €2 fee per parcel for non-EU shipments, could similarly raise costs.

Technology investment and R&D

Temu's fixed costs include continuous investment in technology infrastructure and development. This covers platform maintenance, website and app development, sophisticated AI for demand forecasting, and data analytics capabilities.

The scale of this commitment is demonstrated by PDD Holdings, which reported total R&D expenses of 11 billion yuan (approximately $1.5 billion USD) for the full year of 2023. Sustaining this intensity of R&D investment is critical for exploring new productive forces and enhancing cutting-edge technology support for manufacturing and logistics infrastructure.

These investments support both immediate operations and long-term competitive advantages. Better algorithms mean better product recommendations, which drive higher conversion rates. Improved demand forecasting reduces waste in the supply chain. Enhanced logistics optimization lowers per-unit costs. All of this R&D spending is essential infrastructure for the business model to function at scale.

Compliance and operations

Operational costs also stem from customer service policies and mounting regulatory pressure. Temu's generous "no-questions-asked" refund policy attracts consumers but adds to the overall cost base, particularly given frequent complaints regarding product quality.

Because return shipping cross-border can be expensive, Temu often refunds customers for cheap items without asking for the item back. If a $3 item arrives damaged, Temu might credit the $3 and tell the customer to keep or dispose of it, since shipping it back might cost $5 or more.

Arizona AG Kris Mayes sued Temu over alleged consumer protection violations

Regulatory compliance has transitioned from discretionary expense to critical, unavoidable overhead. The company is also dealing with U.S. data privacy lawsuits brought by the states of Arizona and Nebraska. And in the EU, Temu Temu faces probes over unsafe or counterfeit goods, with potential fines up to 6% of global revenue and higher compliance costs.

Temu’s competitors

Temu has entered the e-commerce arena as a disruptor, using deep supply chain integration and willingness to sustain massive losses to achieve aggressive volume targets. But it faces direct competition from both upstart apps and established giants.

Shein

Shein is Temu's most comparable direct rival due to shared Chinese origins and focus on international, ultra-low-cost retail. However, their models differ significantly. Shein focuses primarily on fashion, using a model where it contracts with manufacturers to produce small batches of owned inventory based on demand signals. Temu operates as a pure marketplace for a wider array of products using the C2M model, transferring inventory risk to third-party suppliers.

Temu's aggressive scaling has rapidly eroded Shein's market lead. In France, Temu achieved larger market share than Shein within months of launching. By mid-2023, Temu's monthly sales in the U.S. were reportedly 20% higher than Shein's in certain months. Despite this, Shein maintains advantages in fashion-specific expertise, brand recognition in apparel, and a more curated selection with consistent sizing and photography.

The rivalry has become heated and litigious. In 2023, Shein filed lawsuits accusing Temu of facilitating counterfeit goods and IP infringement, alleging Temu sellers copied Shein's designs. Temu counter-sued, alleging anti-competitive practices and claiming Shein intimidated shared suppliers to force them to choose Shein over Temu — what Temu called "mafia-style" tactics.

AliExpress

AliExpress, part of Alibaba, is the long-standing global marketplace connecting consumers with thousands of overseas sellers. Before Temu arrived, AliExpress held over 40% market share among Chinese cross-border marketplaces in some European markets.

However, AliExpress feels dated and inconvenient to many modern shoppers. The user interface is less slick, and the burden is on buyers to hunt for the best listing and evaluate seller ratings. Shipping historically could take 3-4 weeks, though some items now arrive in 10-15 days. Critically, AliExpress hasn't invested in aggressive Western marketing in recent years, growing organically through word-of-mouth among deal-seekers.

Temu exploited this by storming in with flashy ads and a polished app, stealing mindshare. And pricing on AliExpress, while cheap, isn't as uniformly, absurdly cheap as Temu's promotions. Temu's heavy subsidies undercut many AliExpress sellers. An item might be $5 on AliExpress with $2 shipping, while Temu offers a similar item for $3 with free shipping.

Amazon

Amazon dominates U.S. e-commerce with approximately 38% market share and $514 billion in net sales in 2022. Temu, by contrast, holds roughly 1% of U.S. e-commerce market share. Amazon's model is built on vast product selection including major brands, fast delivery via Prime, and an ecosystem of services that keep people subscribed.

Amazon is not usually the cheapest source for products, especially for the kind of no-name gadgets and knick-knacks that Temu sells. Many of those same Chinese-made items are sold on Amazon by third-party sellers, but they tend to cost more because sellers factor in Amazon's fees and shipping costs. A kitchen tool might be $3 on Temu but $7.99 on Amazon with Prime shipping.

Interestingly, data shows over 80% of Temu's customers also shop at Amazon, Walmart, or Target. This suggests people use Temu for some purchases and still use Amazon for others. Temu might be capturing purchases that would otherwise not happen or would have gone to dollar stores or AliExpress, rather than directly stealing Amazon's loyal base.

TikTok Shop

TikTok Shop represents an emerging competitor that blends content consumption with direct commerce. The platform allows users to discover and purchase products directly through videos, relying on personalized social media algorithms to drive viral trends and impulse purchasing.

TikTok Shop challenges Temu directly in customer acquisition by targeting the same young, digitally native consumer base. Its biggest strength is engagement — TikTok boasts more than 1 billion monthly users, and its For You feed drives unparalleled time-on-platform. During Black Friday 2025, TikTok Shop reportedly sold over $500 million of products in the U.S. market, signaling growing momentum in social commerce.

The models differ significantly. TikTok Shop thrives on impulse buys driven by viral trends and entertainment, with shopping as almost a byproduct of enjoying content. Temu operates as a more traditional catalog shopping experience where users open the app to search and browse. They overlap in the sense that a consumer might see something on TikTok and either buy it on TikTok Shop or try to find a cheaper version on Temu.

The future of Temu

Temu is at a turning point. The company must manage rising regulation while shifting from loss-driven growth to real profitability. That shift is already changing where it focuses. The U.S., once more than 60% of sales, is becoming less attractive due to slowing demand and policy risk. In May 2025, U.S. consumer spending on Temu fell 36% year over year.

Europe is moving in the opposite direction. Consumer spending there rose 63% year over year in the same period. France is now Temu’s fastest-growing European market. This geographic pivot reduces reliance on the U.S. but exposes Temu to a different and stricter regulatory environment.

The financial challenge is clear. Temu reportedly loses about $30 per order today. To survive long term, it must reduce subsidies while keeping users active and buying. That means turning early, expensive growth into repeat demand.

The path to profitability depends on a few levers. Temu needs higher-margin ad revenue from its internal marketplace. It needs better logistics economics as volume increases. It also needs higher supplier efficiency through its C2M and NGM models.

Some analysts expect break-even in 2025 or 2026, with meaningful operating profit by 2026. But those outcomes require success on all fronts at once. If Temu’s reputation stays tied to low quality, shoppers could leave once discounts fade.

The next two to three years will decide the outcome. Key signals include retention as subsidies fall, stable conversion rates near 2.5–3.0%, and growth in ad revenue. Temu wants to become the global home for ultra-cheap shopping, with a future IPO possible. Whether it can turn scale into profit remains an open question.